Recognising the hardships caused by low rubber prices, the government will allocate RM200 million for "Bantuan Musim Tengkujuh" (Rainy Season Aid) to eligible rubber smallholders under the Rubber Industries Smallholders Development Authority (Risda) and Lembaga Industri Getah Sabah.

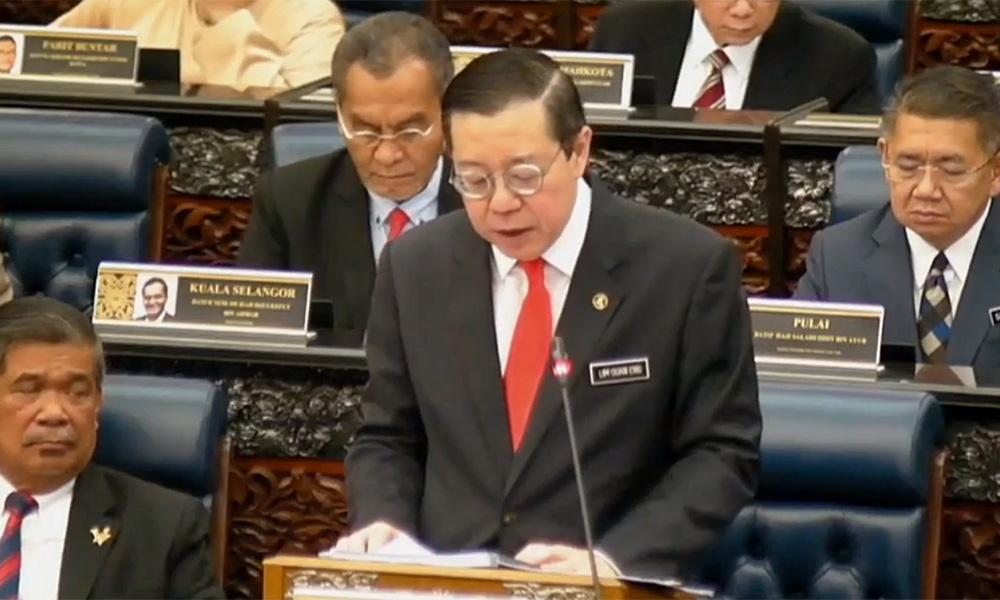

Finance Minister Lim Guan Eng said the government will also allocate RM100 million for the Rubber Production Incentive in 2020 to enhance the income of smallholders faced with low rubber prices.

“At the same time, the government is disappointed by the anti-palm oil campaign launched by the EU and the US,” he said when tabling Budget 2020 in the Dewan Rakyat today.

Hence, an allocation of RM27 million to support the Malaysian Palm Oil Board’s (MPOB) efforts to market palm oil internationally and counter anti-palm oil campaigns.

He added the sector would also be enhanced via the implementation of biodiesel, with the B20 biodiesel for the transportation sector to be implemented by the end of 2020.

Meanwhile, the government will also allocate RM550 million for a palm oil replanting loan fund for smallholders which will be collateral-free at an interest rate of 2 percent per annum with a tenure of 12 years including a four-year moratorium on repayment.

Lim said the replanting would be undertaken using the latest seedlings and would be in compliance with Malaysian Sustainable Palm Oil (MSPO) standards to ensure better productivity and marketability.

“This is expected to increase palm oil demand by 500,000 tonnes per annum,” he added.

Budget 2020, themed “Driving Growth and Equitable Outcomes towards Shared Prosperity” is the Pakatan Harapan government’s second budget after taking over Putrajaya in May 2018.

Lim added that the government will continue to support the smallholdings industry by taking various steps to look after the welfare of smallholders.

The government will provide RM738 million for Risda and the Federal Land Consolidation and Rehabilitation Authority (Felcra) to implement various income-generating programmes that will benefit more than 300,000 Risda smallholders and 100,000 Felcra participants.

“The government is concerned by the impact of low commodity prices on the livelihoods of Malaysians in this sector, particular the smallholders," said Lim.

The finance minister also announced that customised packaged investment incentives of up to RM1 billion would be made available annually over five years to attract targeted Fortune 500 companies and global unicorns in high technology, manufacturing, creative and new economic sectors.

He said to qualify, these companies must invest at least RM5 billion each in Malaysia.

He said this incentive would generate additional economic activities that would support Small Medium Enterprises (SMEs), create 150,000 high-quality jobs over the next five years and strengthen the manufacturing and service ecosystems.

He said to transform Malaysia’s best and most promising businesses into the most competitive enterprises in the global export markets, the government will also make available up to RM1 billion in customised packaged investment incentives annually over five years.

“These incentives are strictly conditional upon these companies proving their ability to grow and export their products and services globally,” he added.

Lim said the government expects this measure to significantly strengthen the local supply chain ecosystem and create additional 100,000 high-quality jobs for Malaysians over the next five years.

At the same time, he said the government would allocate RM10 million to expedite approval of investments and the Ministry of International Trade and Industry would give additional focus to post-approval investment monitoring and realisation.

“This year, the government embarked on a comprehensive review and revamp of the existing incentive framework, comprising the Promotion of Investments Act 1986, Special Incentive Package and incentives under the Income Tax Act 1967,” he added.

Lim said the new framework is expected to be ready by Jan 1, 2020. - Bernama