Goldman Sachs Group Inc, the bank that was responsible for arranging three bonds for 1MDB totalling US$6.5 billion, a substantial sum of which was subsequently misappropriated, said it was working on recovering the stolen funds for Malaysia.

Goldman Sachs president and chief operating officer John Waldron, in an interview with Bloomberg Television, said he hopes to put an end to the saga.

“We’re looking to put it behind us and get the Malaysian people the money that they deserve,” he was quoted as saying on the 1MDB matter.

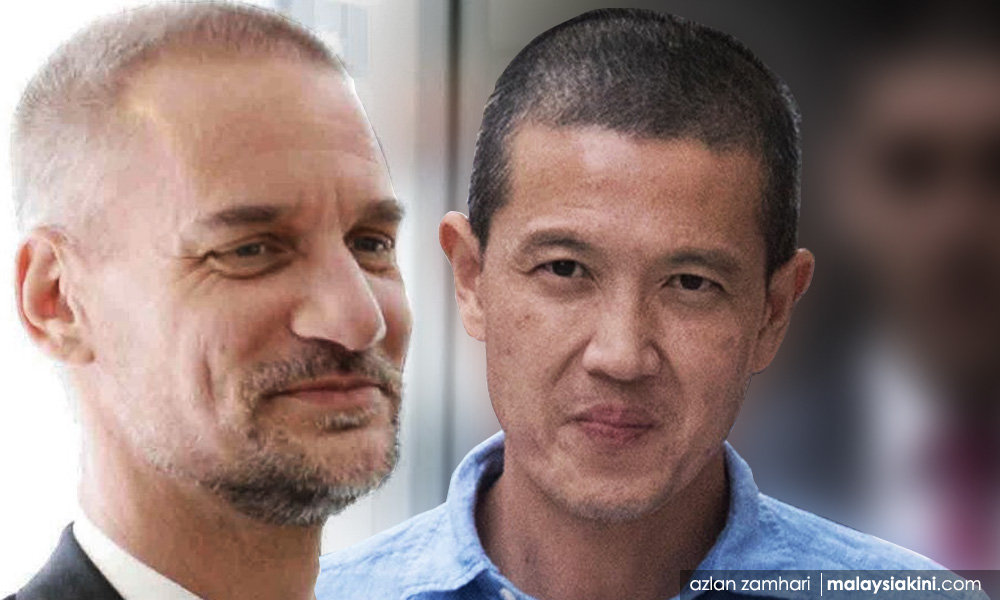

In December last year, the Attorney-General's Chambers filed criminal charges against Goldman Sachs subsidiaries and their former employees Tim Leissner and Roger Ng Chong Hwa.

Last month, criminal charges were also brought against 17 former and current Goldman Sachs executives in relation to the 1MDB matter.

"The charges were brought against them for perpetrating a scheme to defraud the government of Malaysia and purchasers of three bonds with a face value of US$6.5 billion (RM27.38 billion) which were underwritten and arranged by Goldman Sachs, and issued by subsidiaries of 1MDB, by way of the commission and abetment of false or misleading statements to dishonestly misappropriated billions from the bond proceeds," Attorney-General Tommy Thomas had said.

Goldman Sachs has also come up in former prime minister Najib Abdul Razak's ongoing 1MDB graft trial.

At the start of Najib's case last month, lead prosecutor Gopal Sri Ram, a former federal court judge, referenced Goldman Sachs five times in his opening statement.

Goldman Sachs made lucrative fees by arranging three bonds for 1MDB, proceeds of which were allegedly misappropriated to benefit several individuals, including Najib.

Goldman Sachs have lawyers present during the proceedings of Najib's case as it gears up for its own case brought against it by the Malaysian government.

In January, Goldman Sachs chief executive David Solomon apologised to Malaysia for Leissner's role in the 1MDB scandal but insisted the bank had conducted its due diligence.

“It’s very clear that the people of Malaysia were defrauded by many individuals, including the highest members of the prior government," Solomon had said.

Finance Minister Lim Guan Eng has said that the apology was insufficient and that the government wants compensation from Goldman Sachs.