Deep in the Australian outback, rare earths miner Lynas Corp is assessing its options for an initial processing plant, as it looks to soothe concerns in Malaysia about radioactive waste.

Lynas has four years to build a plant that will remove low-level radioactivity from the material it ships to the Southeast Asian nation for separation into elements vital for products ranging from fighter jets to wind farms.

The so-called cracking and leaching plant is one of two conditions Malaysia placed on the company when it recently renewed its licence, which will be reviewed again in six months. It will be built as part of a $500 million (RM2.1 billion) growth strategy to boost production by 2025.

At its Mt Weld mine, an ancient volcano some 12 hours drive from Perth, Kam Leung, vice president of production, said Lynas is well advanced in plans to build the plant, either by the mine or four hours drive south at the gold mining town of Kalgoorlie.

"We can do it all well within the four years," he said. "We are reviewing both and it will come down to an elimination process based on which site has the lowest risk."

The global spotlight has focused on Lynas this year as the world's only major producer of rare earth metals outside China, particularly as concerns mount that Beijing could constrain exports amid rising trade tensions.

Mt Weld lies 20km south of Laverton, a town of 250 people, one pub, a hospital and a couple of shops, the last stop before Australia's vast arid centre.

This red dirt-encrusted region is sprinkled with mines, mostly nickel and gold, interspersed by low scrubland where cattle graze and wild camels wander.

Lynas produces a rare earth concentrate that it currently trucks 35 km, then rails more than 800km to the coast, where it is shipped to Malaysia to be separated into elements such as Neodymium and Praseodymium (NdPr), used in industrial magnets.

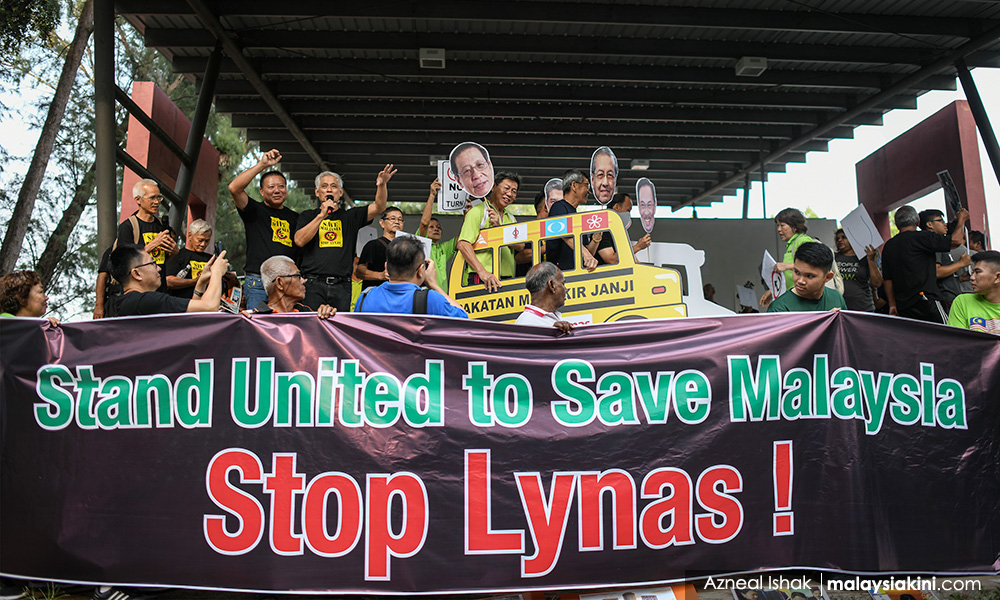

However, stores of low-level radioactive waste at the Kuantan processing plant, which Lynas says are well within safety regulations, have angered nearby residents.

Leung said the new plant, which will turn ore concentrate into rare earth carbonate, would take around a year to construct, while the lead time for ordering equipment would also be around a year.

Lynas would apply for relevant permits concurrently and could also relocate some infrastructure from Malaysia.

The choice of site will be based on issues like access to water, transportation costs, availability of chemicals and skilled labour, he added.

"I imagine we'd basically double our workforce, including contractors ... We certainly would like to bring some of our Malaysian employees across, they've got years of experience."

Analysts expect Lynas to meet the timeline to build the plant.

"Lynas wouldn't release a timeline without significant confidence they can achieve it," said analyst Dylan Kelly of Ord Minnett in Sydney in a recent client note.

Lynas is also advancing plans to clear its current waste in Malaysia. It has six months to identify a site for a permanent storage facility or find another country to take the waste.

At Mt Weld, Leong said the company will be focused on keeping costs down at the new plant, given analysts estimate its prices are a third higher than China's, and having only recently secured a strategic debt extension from Japan.

"We can't rely on the metal price to keep us afloat - we need to have our costs under control."