Maju Holdings Sdn Bhd's revived bid to take over Plus Malaysia Bhd – the biggest highway operator in the country – appears to be causing some friction in Putrajaya.

Maju Holdings had originally proposed to do so in 2017. To sweeten the deal, it offered to freeze toll prices for 20 years.

Eventually, the BN administration expressed doubt about the viability of the proposal and rejected it.

The Finance Ministry also told Parliament at the time that the government did not want to bail out Plus if things went south.

Maju Holdings is now trying its luck again with the new executives in Putrajaya.

Works Minister Baru Bian, who oversees public infrastructure, told reporters yesterday that his ministry had received the firm's fresh proposal and that the matter would be studied in cabinet.

According to The Edge Markets, Maju Holdings is offering RM3.5 billion for Plus, and will assume its debts of about RM30 billion.

The business paper also reported that the company planned to lower toll charges, between 25 percent to 36 percent, in exchange for extensions to the toll collection period, between 10 to 30 years.

It is believed that the appeal of Maju Holdings' deal is that it will eliminate government compensations in lieu of toll charge increases, and also meet political objectives of reducing toll rates gradually.

It is understood that cabinet has yet to deliberate on this.

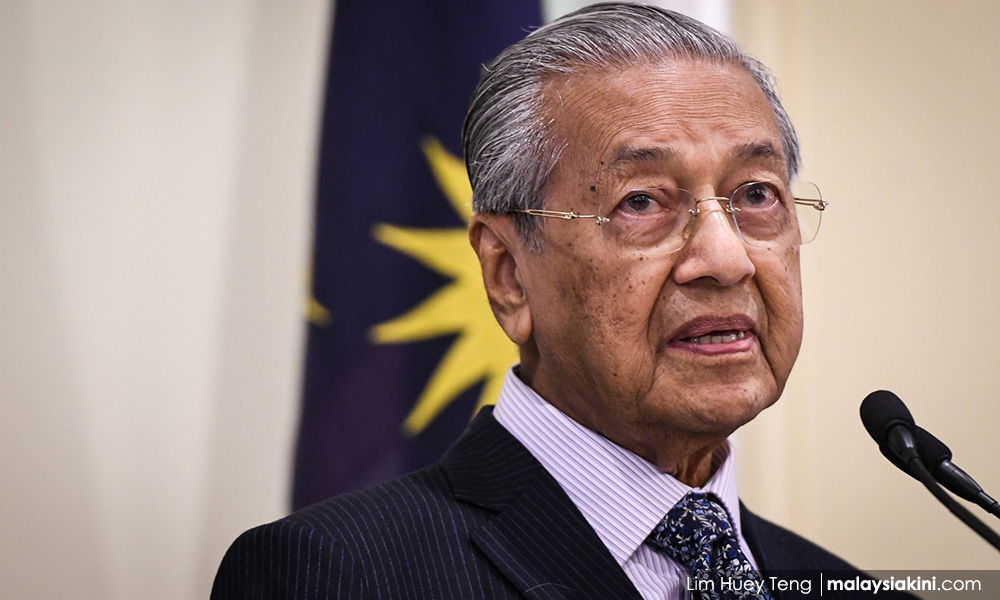

Dr M to have final say?

However, Prime Minister Dr Mahathir Mohamad had gone on record to say that Finance Minister Lim Guan Eng was not interested in the proposal.

Lim himself had stated that Plus' two shareholders – Khazanah Nasional Bhd (51 percent) and EPF (49 percent) – are not keen.

EPF is parked under the Finance Ministry and Khazanah is parked under the Prime Minister's Department – but with the ministry represented by Shahril Ridza Ridzuan as managing director.

In a report published on July 1, The Edge Markets had asked Mahathir about Lim's opposition to the deal, to which the prime minister said: "He (Lim) doesn't want."

Mahathir also signalled his doubt over whether the government could nationalise all the highways in the country.

"It's difficult because it is going to cost a lot of money, but we don't have money," he said.

"I don't know. He (Lim) seems to think that he (the government) can take (over) the highways and charge during the rush hour (and) collect tolls.

"But I don’t know whether (this will work) for the urban highways. Yes, we will see."

This was likely in reference to the Lim-initiated experiment of nationalising four highways in the Klang Valley.

The plan was to finance the nationalisation process by levying a congestion charge.

Lim had said that this method, if successful, could be a model for the government take over of other highways.

What is Maju Holdings?

Maju Holdings is a privately-held company controlled by Abu Sahid Mohamad, who stepped down as the chair of Perwaja Holdings Bhd in 2013.

Its best-known projects are the Bandar Tasik Selatan bus terminal (BTS) and the Maju Expressway (MEX).

Most of its key infrastructure projects were won during the latter half of Mahathir's first tenure as prime minister.

The company seems rather fond of Mahathir, and regularly pays tribute to the prime minister on a digital billboard affixed to one of its skyscrapers near TBS.

Incidentally, The Edge Market's interview with Mahathir was conducted at the sidelines of Abu Sahid's Hari Raya open house event on July 24 in Sungai Besi. Baru was spotted at the same event.

Plus, which runs five highways and the Penang Bridge, is a loss-making company. Abu Sahid had told The Edge Markets that he could turn things around.

Putrajaya's intentions with Plus and other highways might become clearer in coming weeks when the cabinet finally deliberates on the report by an independent consultant commissioned by the Works Ministry.

Baru previously explained that this consultant would suggest solutions to ease the burden on highway users.

Previously, Deputy Works Minister Mohd Anuar Mohd Tahir said that this report would be tabled to cabinet in June.

Cabinet meets again next Friday.