The government lawsuit against Najib Abdul Razak (photo) seeking him to pay RM1.69 billion in income tax owed to the Inland Revenue Board (IRB) for the assessment years 2011 to 2017, has been fixed for case management on July 25.

High Court deputy registrar Erry Shahriman Nor Aripin fixed the date yesterday after the case came up before him via the e-review system (an online forum within the e-Court system which enables judicial officers and legal representatives in a case to conduct case management via an exchange of written messages without having to attend court).

The case management on July 25 will be heard before Erry Shahriman.

It is learnt the writ of summons had been served to Najib as the sole defendant on July 4.

On June 25, the government, through IRB, filed the suit against Najib seeking him to pay a total of RM1,692,872,924.83, with interest at 5 percent a year from the date of judgment, as well as cost and other relief deemed fit by the court.

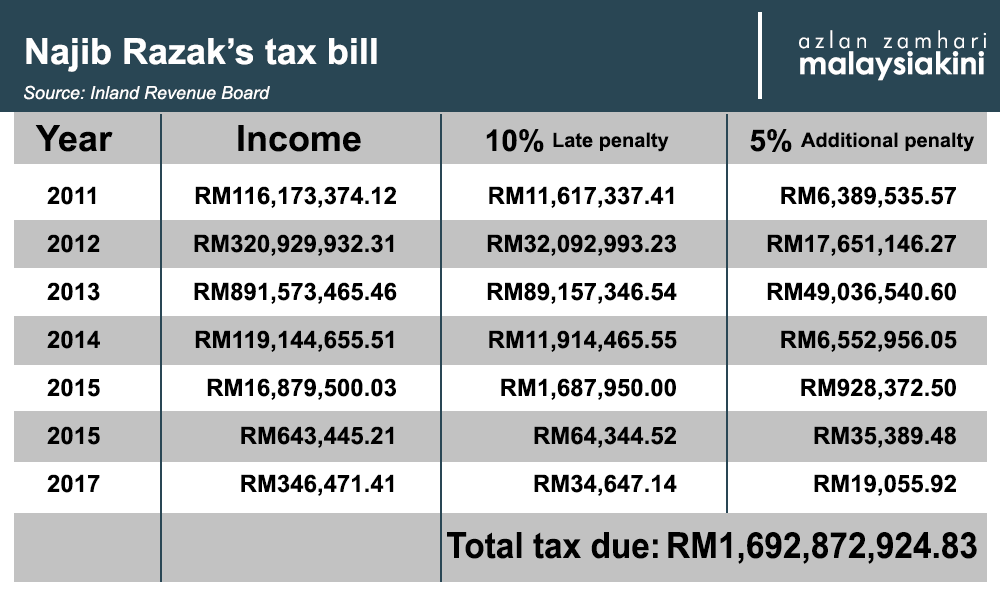

In the statement of claim, the government said, as stated through a notice of additional assessments dated March 20, 2019, the additional tax assessments on Najib’s income for the assessment year of 2011, 2012, 2013, 2014, 2015, 2016 and 2017 were RM116,173,374.12; RM320,929,932.31; RM891,573,465.46; RM119,144,655.51; RM16,879,500.03; RM643,445.21 and RM346,471.41 respectively.

The government claimed the notice was sent via registered mail to Najib on March 25, 2019, to his last known address at Jalan Langgak Duta, Taman Duta, and the mail was never returned to IRB.

Since Najib failed to pay the taxes within the stipulated 30-day period as required under Section 103 of the Income Tax Act 1967, the amount was increased by 10 percent, amounting RM11,617,337.41; RM32,092,993.23; RM89,157,346.54; RM11,914,465.55; RM1,687,950.00; RM64,344.52 and RM34,647.14 for the assessment years from 2011 to 2017, respectively.

It also said that Najib was given 60 days to pay the taxes, together with the 10 percent increase, but still failed to do so.

Following which, Najib was slapped with another 5 percent increase on the 10 percent hike, amounting to RM6,389,535.57; RM17,651,146.27; RM49,036,540.60; RM6,552,956.05; RM928,372.50; RM35,389.48 and RM19,055.92 for the stipulated assessment years, bringing the total amount of income tax due to RM1,692,872,924.83.

- Bernama