COMMENT | Wan Saiful Wan Jan, chairperson of PTPTN, is fast becoming Malaysia’s very own (British Prime Minister) Theresa May – a very good person with a seemingly impossible job.

Rightly admired for his honesty and insightful thought-leadership, Wan Saiful and his team at PTPTN have done an excellent job in laying out the current PTPTN loan crisis – which is bigger than 1MDB – and the suggestions so far from stakeholders on how to solve it.

The main problem is that the task given to Wan Saiful and his team forces them to focus on only one option – to make students repay the debt. This aim is bound to fail and the honest and forensic analysis by Wan Saiful’s team makes this crystal clear.

We must be fair and acknowledge that the proposals presented in the PTPTN website come from stakeholders, not from PTPTN or Wan Saiful himself. They lay out clearly what stakeholders have suggested along with PTPTN’s assessment of the implications for everyone concerned.

They are truly terrifying and make BN look like the students’ friendly grandmother – a terrifying prospect for Pakatan Harapan politicians and supporters alike.

For those who have not seen what some stakeholders suggest a brief summary may be informative. The first proposal is to defer payment for students earning RM2,000 per month or less. This would help 26 percent of students but would not by itself solve the non-payment problems for those earning more than RM2,000 per month without additional enforcement measures.

The second proposal is to defer payments for students earning less than RM4,000 per month, which fulfils Harapan’s election pledge. This would leave PTPTN waiting between six to 15 years for repayments and cause its debts to rise to an eye-watering RM100 billion by 2040.

The third idea stakeholders have proposed has already been rejected. This is to link repayments to salary, which last time suggested that those earning RM8,000 per month or more should pay 15 percent of their monthly income repaying loans.

This idea is so bad for Harapan that we can only guess it was suggested by those dreaming of a BN victory in GE15.

Stakeholder suggestions then move on to more punitive ideas which punish not just student defaulters but also their parents, siblings and the universities where they studied.

Idea #4 is to raid student salaries, a proposal which some have already rejected arguing that is not only immoral but also potentially illegal.

Next comes Idea #5 - making students bankrupt if they fall behind on repayments. This idea was possibly suggested by lawyers who see piles of income in litigation fees.

Idea #6 denies the lawyers their cash-cow but reintroduces the much-hated travel bans albeit in a different form. Restrictions on the renewal of passports, driving licences, business licences and even road tax are proposed. There’s an end to graduate entrepreneurs and a massive increase in illegal road-users.

It doesn’t end there, however. Within the same proposal are public shaming of students and visiting the sins of defaulters on their siblings by denying family members PTPTN loans in default.

Idea #7 continues this theme by forcing debt repayments on unsuspecting “guarantors” – read “parents.” So much for family harmony.

Idea #8 punishes success by denying first-class graduates their loan waiver and Idea #9 punishes universities by denying them PTPTN loans if they underperform on the national rating system. Neither really addresses the problem on non-payment.

Finally, Idea #10 comes as a form of light-relief following the other suggestions by proposing increasing the interest rate paid by students from the one percent they currently pay to perhaps the five percent that PTPTN borrows the money at in the first place.

This would save the government around RM1.7 billion per year but raises the question - why would students be more likely to repay loans at five percent when they are currently not paying at one percent?

We must not misunderstand this process. The analysis from Wan Saiful and his team is first-class and although they may not get a loan exemption, they should be given credit for telling the truth. They should also be given credit for seeking public views on these proposals – an exercise in active democracy that should be emulated in other policy debates.

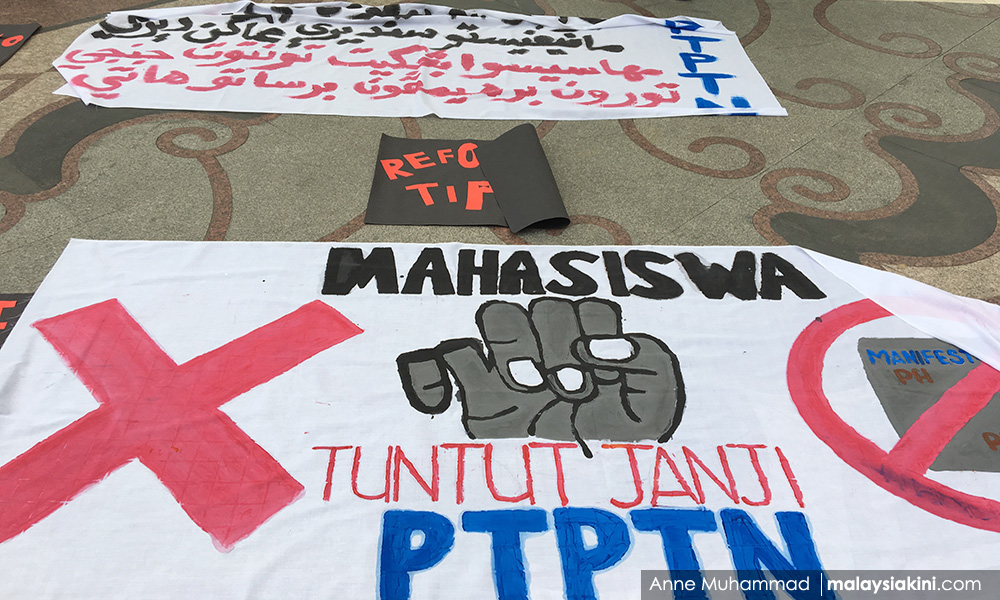

The real problem is that as long as the debate on PTPTN reform focuses on the single aim of making students pay, this problem will rumble on. PTPTN will become more unstable, students and parents will be more and more worried and universities will continue to struggle with uncertainty about future finances.

We must set aside the “make students pay” mantra and open up the debate to look for a sustainable and holistic solution to higher education financing. This solution must examine diversifying finance for higher education within a portfolio of alternative income sources which balance government support and loans with income from research, development and commercialisation, endowments and system reform.

As a general rule, when your stakeholders give you solutions which will not work – look for other solutions.

GEOFFREY WILLIAMS is a professor at ELM Graduate School at HELP University.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.