Former Lembaga Tabung Haji chairperson Abdul Azeez Abdul Rahim has disputed Minister in the Prime Minister's Department Mujahid Yusof Rawa's statement that the pilgrimage fund has an RM4.1 billion deficit.

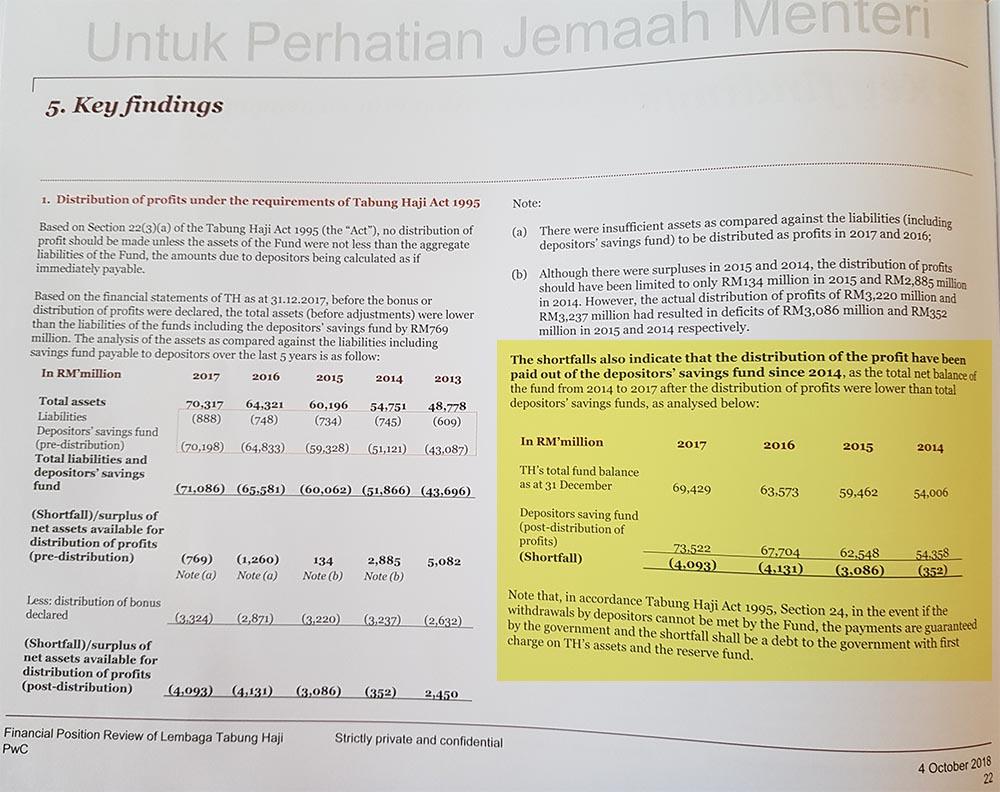

Based on an independent review by PriceWaterhouseCoopers (PwC), Mujahid revealed yesterday that Tabung Haji has assets of RM70.3 billion as opposed to liabilities of RM74.4 billion, representing a deficit of RM4.1 billion as of end-2017.

Citing reviews by independent auditor Ernst & Young under the BN administration, however, Azeez said that Tabung Haji's assets should instead stand at RM74.7 billion and its liabilities at RM74.4 billion – representing a surplus of RM373 million.

This discrepancy was actually explained in PwC's financial position review, which was tabled in the Dewan Rakyat yesterday.

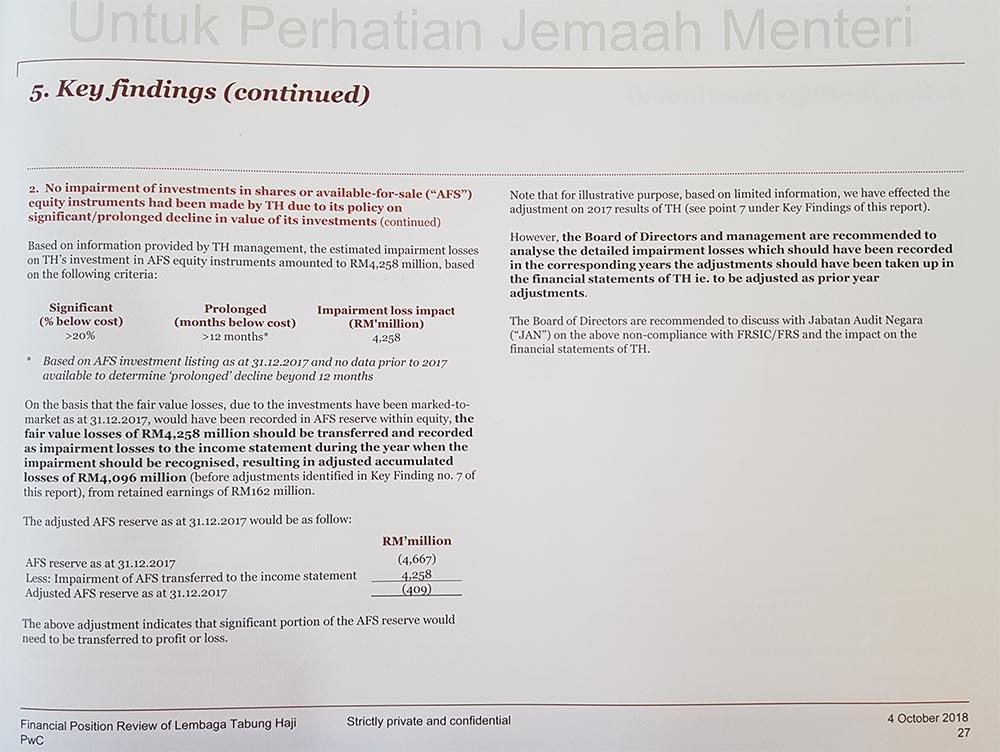

According to PwC, there was RM4.258 billion in impairment losses in equities, which Tabung Haji had previously hidden through creative accounting.

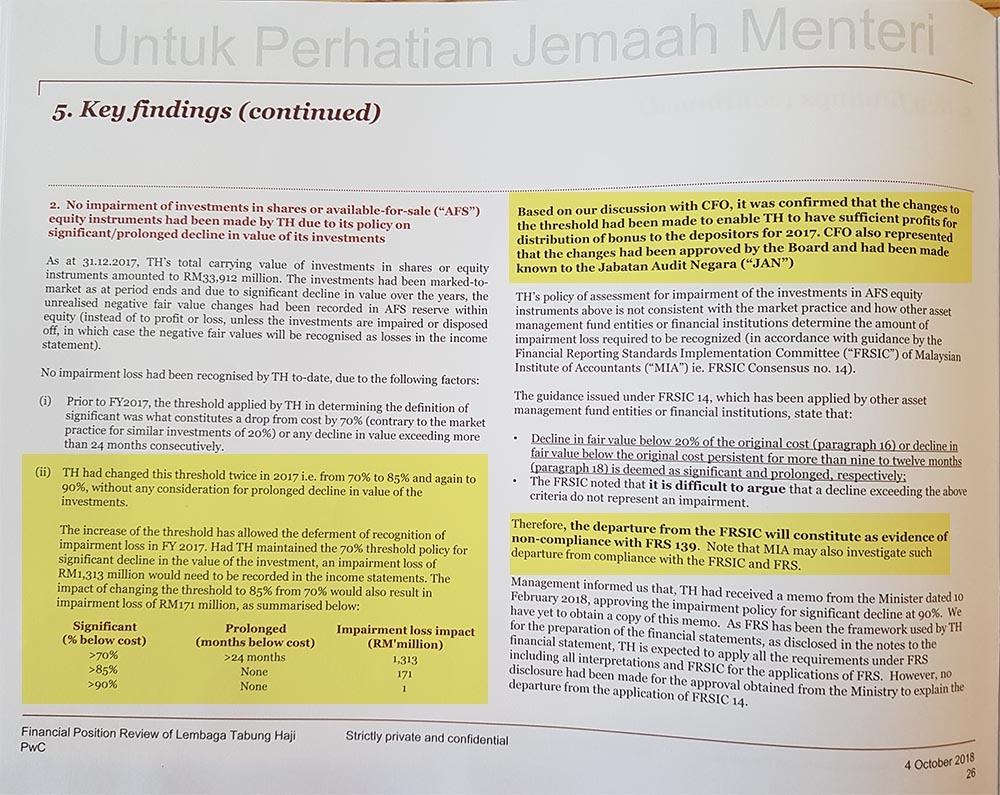

Manipulated thresholds

According to financial reporting standards, a company must declare its impairment loss if the value of purchased shares falls by more than 20 percent of the original cost persistently for a period of nine to 12 months.

However, PwC said Tabung Haji's threshold was set at 70 percent over a period of 24 months. It adjusted this twice in 2017, to 85 percent then to 90 percent.

According to PwC, if the threshold was at 70 percent, Tabung Haji would have needed to declare an impairment loss of RM1.313 billion; at 85 percent, it would need to declare a loss of RM171 million; and at 90 percent, it would only need to declare a loss of RM1 million.

The audit firm added that the hiding of losses was aimed at showing enough profit so that Tabung Haji could issue dividends in 2017. The Tabung Haji Act 1995 does not allow the distribution of dividends if the pilgrimage fund is in deficit.

"Based on our discussion with the chief financial officer (of Tabung Haji), it was confirmed that changes to the threshold have been made to enable Tabung Haji to have sufficient profits for distribution of bonus to the depositors for 2017."

"The chief financial officer also represented that the changes had been approved by the board and had been made known to the Auditor-General's Department," it said in its financial position review of Tabung Haji.

Non-compliance with standards

PwC said the threshold previously used by Tabung Haji did not comply with financial reporting standards.

It added that its review of Tabung Haji for 2017 was based on financial reporting standards where impairment losses must be declared if the value falls by more than 20 percent and is sustained for 12 months.

Based on these standards, PwC said, the total impairment loss in equities was RM4.258 billion.

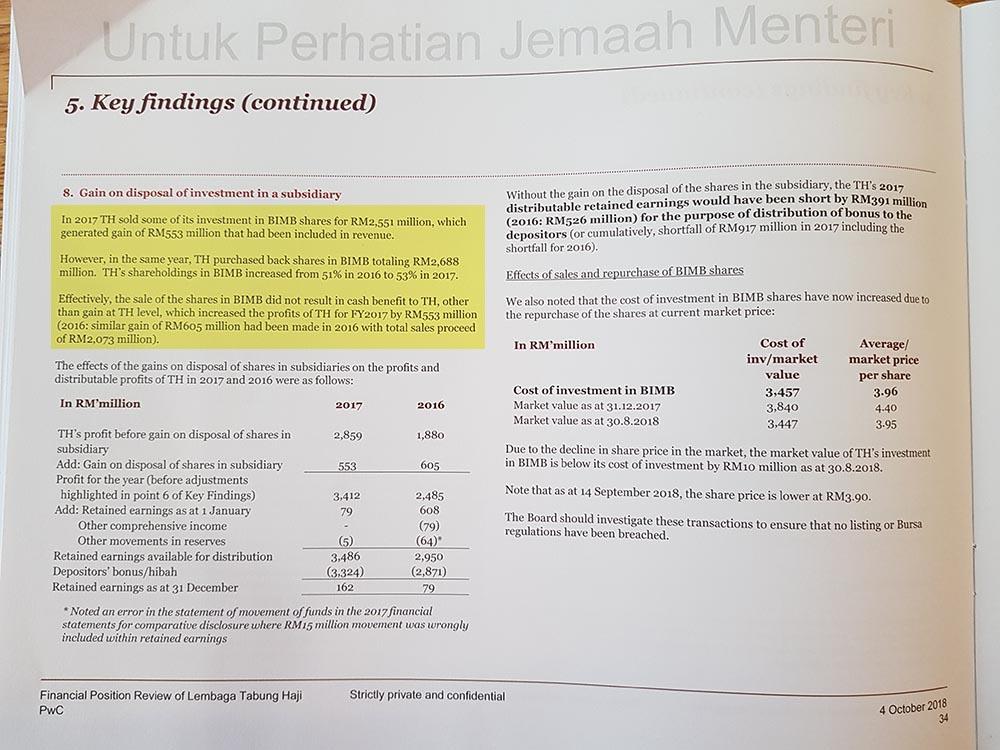

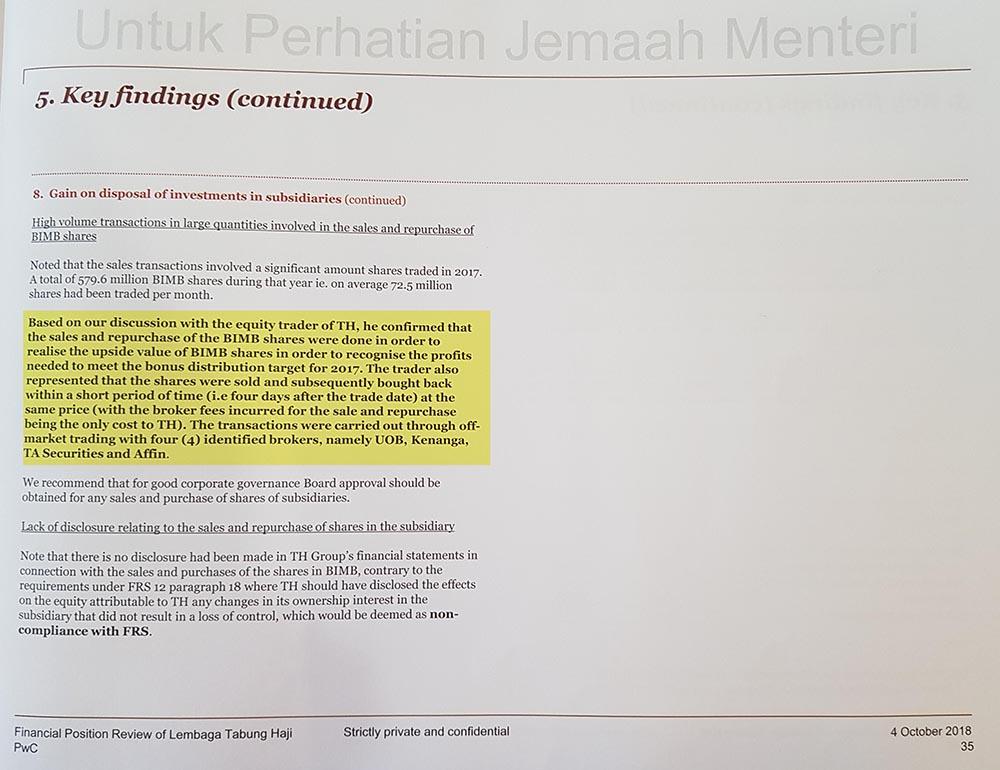

Apart from hiding losses, it was also found that Tabung Haji sold shares to report a profit, and later repurchased them and incurred additional brokerage cost as well as having subsidiaries declare high dividends that were never fully paid.

Without this creative accounting, Mujahid said, Tabung Haji would have been in deficit since 2014. Nevertheless, it continued to issue dividends in contravention of the Tabung Haji Act.

Azeez, in a press conference at Parliament today, said he was shocked by Mujahid's claim.

"I would like to stress that the Tabung Haji management (during my time) did not violate the at and had not committed any wrongdoing.

"Muhajid failed to account for Ernst&Young's valuation of realised assets involving its subsidiaries, associate companies, joint ventures and real estate.

"What he considered was merely the financial statement," he said.

Below are excerpts of PWC's financial position review of Tabung Haji which was tabled in the Dewan Rakyat yesterday:

On paying dividends using deposits

On hiding losses

On selling and rebuying shares to show profit

RELATED REPORTS

Umno veep backs call for RCI into Tabung Haji's finances

Tabung Haji to transfer RM19.9b assets including 1MDB land to SPV

Najib warns 'bank run' can further destabilise Tabung Haji

Anwar: Good move to put Tabung Haji under Bank Negara supervision

PAS: Tabung Haji's deficit could be Harapan 'playing on figures'