New York developer Steven Witkoff, who with his partners won the bidding for the Park Lane Hotel in Manhattan, New York, for US$654 million in July 2013, is now being forced to sell the 47-storey tower property, The New York Times (NYT) reported.

This was part of the US Department of Justice's (DOJ) efforts to forfeit the assets held by Penang-born businessman Jho Low, who is accused of siphoning hundreds of millions of dollars from 1MDB to purchase art, a private jet and real estate in Beverly Hills and in New York.

Low, who dined with Witkoff in 2013, had agreed back then to finance 85 percent of the US$654 million they were paying for Park Lane Hotel.

Low also provided the US$100 million non-refundable deposit - twice the sum typically put up - that convinced the sellers to choose the Witkoff group over a rival bidder with a slightly higher offer.

Witkoff thought this would be the best location to build a supertower with ultra-luxury apartments. But no work ever started on the planned new tower.

He and his remaining partners are being forced by DOJ to put the building up for sale and a glossy marketing book is being sent to prospective bidders this week.

"This was the best site in New York City and maybe the world," Witkoff said in an interview. "We designed what the entire partnership thought was a beautiful building. Little did we know we’d face circumstances like this."

However, Witkoff was reluctant to go into detail on his dealings with Low, given the investigations and associated litigation.

Low has disappeared, and is possibly holed up in a hotel in Shanghai.

Low has disappeared, and is possibly holed up in a hotel in Shanghai.

Part of the siphoned money was said to help finance the Martin Scorsese movie, “The Wolf of Wall Street”, which starred Leonardo DiCaprio.

Low has reportedly denied any wrongdoing involving 1MDB funds, as has Prime Minister Najib Abdul Razak.

The DOJ said that US$731 million from 1MDB was deposited into accounts belonging to an official identified as "Malaysian Official 1" (MO1), who is widely believed to be Najib.

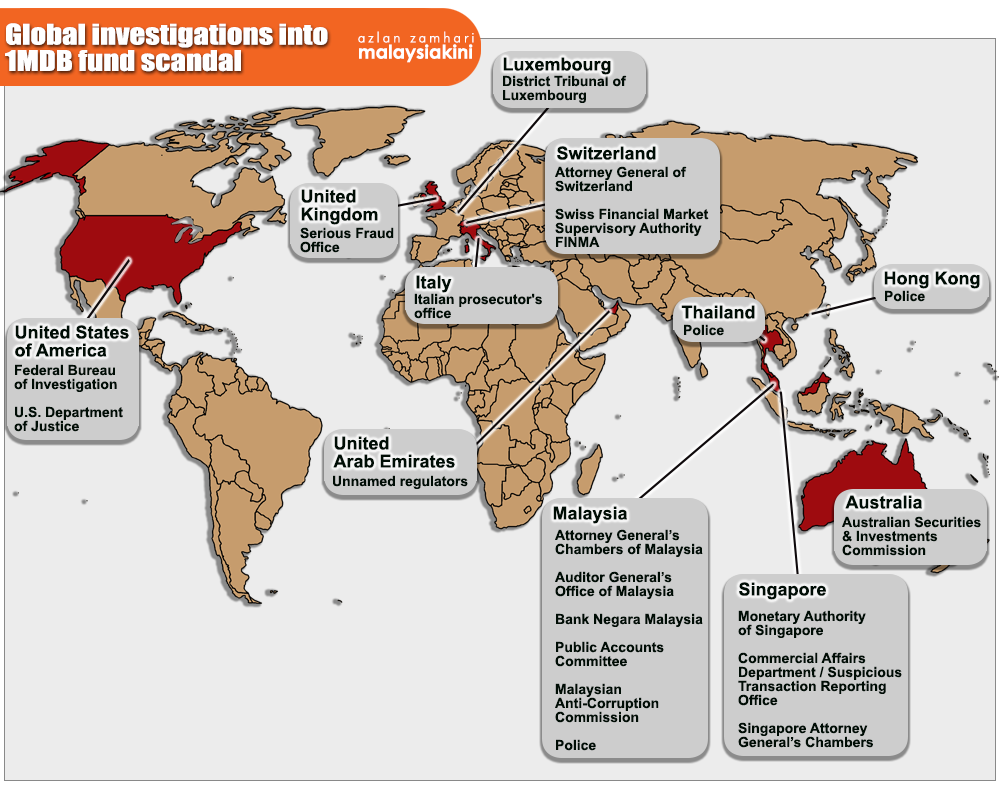

Authorities have shut down two Swiss banks and jailed several bankers. Investigations into laundered funds are underway in the United States, Switzerland Malaysia and at least three other countries.

Witkoff and his partners, New Valley LLC, Highgate Holdings and developer Harry Macklowe, had 15 percent of the Park Lane Hotel deal.

At the last minute, Low took a 55 percent stake and brought in Abu Dhabi state-owned Mubadala Development Company for the remaining 30 percent, NYT reported.

It was also reported that an executive of Witkoff’s office sent an email to Low, in November 2013, asking, “Where the money on your side of the deal is coming from?”

Low said the money would be from his family.

At the closing, US$202.2 million of Low’s contribution came from client escrow accounts from one of his law firms, DLA Piper.

855-feet glass tower designed

The group hired the Swiss architects Herzog & de Meuron to design an 855-feet glass tower. The developers figured the condominiums would command more than $8,000 a square foot.

Low’s contribution to the design was simple: Put outdoor swimming pools on the exterior galleries of each of the five penthouses, according to executives involved in the deal who requested anonymity because of the litigation.

"He didn’t 'like it'. He loved it," said Witkoff.

In late 2015, the Park Lane owners were preparing to refinance the debt used to buy the property, reported the daily.

In late 2015, the Park Lane owners were preparing to refinance the debt used to buy the property, reported the daily.

Low told his partners and the lender that his money came from family trusts established by his father.

But JP Morgan Chase, the new lender in the deal, could not find out much about the Low family before 2009, and raised questions.

It was at this period that stories about 1MDB and the relationship between Najib and Low started to appear.

Low told his partners that the claims of alleged wrongdoing were baseless, the work of rival political parties in Malaysia.

The DOJ initiated an investigation after reports were published and explored the use of shell companies to purchase real estates in the US.

In July 2016, Low failed to make a loan payment on the Park Lane mortgage. At the same time, DOJ filed its civil complaint seeking to recover more than US$1 billion in assets.

The case represents “the tip of the iceberg” when it comes to corruption and money laundering, said Heather Lowe of Global Financial Integrity, a Washington-based non-profit body that focuses on illicit financing.

"There is so much money moving around the world every day," Lowe said. "There is a need to focus on funds going into banks and high-value real estate and how that may be facilitating corruption and poverty around the world."

Under a cooperation agreement between Witkoff and DOJ, the hotel is to be sold and the proceeds divided between Mubadala and Witkoff’s group. The government will take Low's share.

The sale is being handled by Eastdil Secured, a real estate services company.

The marketing books are expected to arrive this week. The pitch: The Park Lane is "the world’s best development site."

The sellers hope the bids will exceed $1 billion, NYT reported.