US investigators are trying to determine if Goldman Sachs Group Inc broke the law when it did not alert authorities over a suspicious transaction involving troubled state fund 1MDB.

The Wall Street Journal (WSJ) today reported that US law-enforcement authorities have sought to schedule interviews with Goldman executives according to people familiar with the matter, though the bank has not been accused of wrongdoing.

The bank said it would not have known how 1MDB would use the money they raised for the state fund.

Goldman had raised US$3 billion via a bond issue for 1MDB back in March 2013, supposedly to fund a major real estate project in Kuala Lumpur to boost the country's economy.

The bank had sent the proceeds raised to a Swiss bank account controlled by 1MDB.

Days after this, half the money disappeared offshore, with some ending up in Prime Minister Najib Abdul Razak's bank account later, according to people familiar with the matter and bank-transfer information viewed by WSJ.

Now, investigators are trying to determine whether Goldman failed to comply with the US Bank Secrecy Act, which requires financial institutions to report suspicious transactions to regulators.

"The investigators believe the bank (Goldman) may have had reason to suspect the money it raised wasn't being used for its intended purpose, according to people familiar with the probe.

"One red flag, they believe, is that Goldman wired the US$3 billion in proceeds to a Singapore branch of a small Swiss private bank instead of to a large global bank, as would be typical for a transfer of that size, the people said," WSJ reported.

Another red flag, they said, is the timing of the bond sale and why it was rushed.

The deal happened in March 2013 which is two months after Najib approached Goldman Sachs bankers during the annual World Economic Forum meeting in Davos, Switzerland and two months before the tough 13th general election campaign for Najib.

WSJ added that Najib had used some of the cash from his personal bank account on election spending, citing bank transfer information and people familiar with the matter.

The prime minister has also consistently denied wrongdoing in this matter, saying that the money was a political donation from Saudi Arabia, with attorney-general Mohamed Apandi Ali finally clearing him of wrongdoing in January.

"Goldman has said it did proper due diligence on 1MDB.

"But several current and former Goldman executives said in interviews soon after the bond deal that because this was a government-owned fund run by the prime minister, the bank could largely rely on their word that the money was being used as intended.

"The executives also said that corruption was common in many developing markets and the bank couldn’t do business there without interacting with people and organisations that were potentially corrupt," WSJ said in their report today.

Goldman paid US$300 million

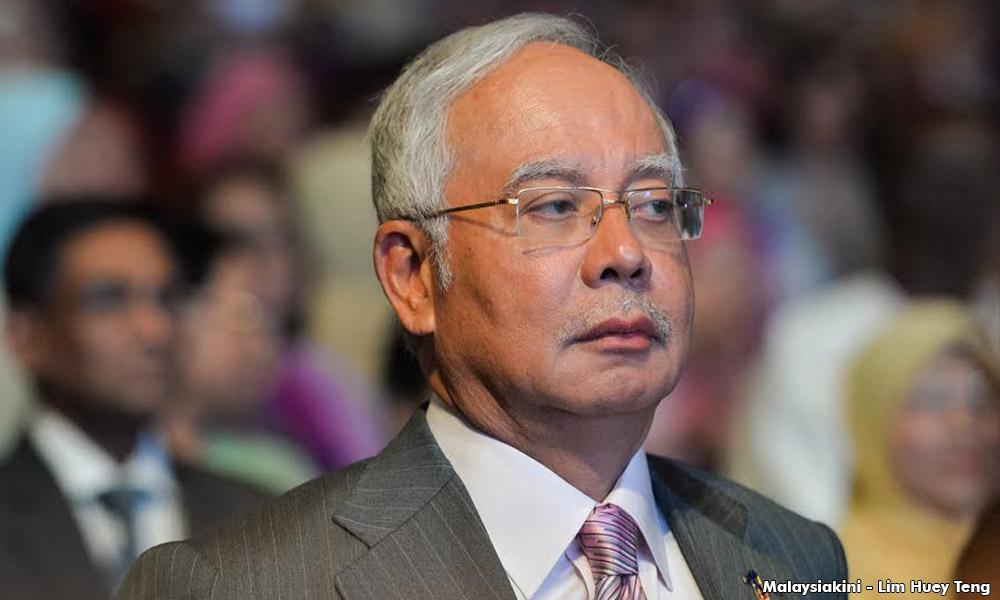

Goldman had effectively bought the entire US$3 billion issue after they were asked by Najib (photo) to handle the bond offering.

They then gave 1MDB the proceeds and held the bonds on its balance sheet until it could sell them off to investors.

They then gave 1MDB the proceeds and held the bonds on its balance sheet until it could sell them off to investors.

The bank was paid about US$300 million for its efforts, a sum far above fees for similar offerings and one of the bank's biggest paychecks for that year, though Goldman has defended the fees as commensurate with the risk it assumed by buying the entire bond issue.

However, 1MDB later claimed that Goldman overcharged it and sought a partial refund, with Goldman's top regional banker at that time Tim Leissner taking the request to his colleagues who then rejected it, said people familiar with the matter.

Leissner had resigned from Goldman earlier this year after investigators found he allegedly violated company policies by sending an unauthorised reference letter to another financial firm on behalf of a person involved with 1MDB, WSJ added.

Leissner had also been present at a meeting to launch the predecessor of 1MDB in 2009 and Goldman had later made hundreds of millions of dollars underwriting three bond deals worth a total of US$6.5 billion and advising on two acquisitions for 1MDB.

Investigators are now questioning why 1MDB needed the cash so quickly for a property development project which would take years to complete, WSJ said.

"Investigators are also looking into questions raised by Goldman's lawyer on the deal, Kevin Wong, a Singapore-based partner with Linklaters, who sent a note to Goldman bankers alerting them to the fact the money was to be sent to a private bank, according to a person familiar with the matter.

"Goldman checked the credentials of the bank, Switzerland's BSI SA, and found no reason not to send money there, the person added.

"Wong declined to comment. A BSI spokeswoman didn't respond to a request for comment," WSJ reported.

According to WSJ, 1MDB said half of the US$3 billion bond issue was funneled from BSI into offshore investment funds because it wasn't needed immediately.

Some of the money ended up in Devonshire Funds, which is run by a Bangkok-based financial firm, according to bank transfer information reviewed by WSJ.

"Devonshire in turn sent US$210 million to Tanore Finance, a now-defunct British Virgin Islands shell company. An employee of Devonshire declined to comment.

"Tanore also received other money that originated with 1MDB, according to investigators and bank transfer documents," WSJ said.

The US financial daily said in the same month Goldman had sold the US$3 billion bond, Tanore had transferred US$681 million into Najib's private bank account, according to investigative documents.

1MDB is currently being investigated in at least seven countries, with investigators believing more than US$6 billion of 1MDB's money being unaccounted for, WSJ added.

Malaysiakini could not independently verify the claims made in the WSJ report.