Red Granite, the Hollywood firm owned by prime minister's stepson Riza Aziz, denies any "inappropriate" activity, following Swiss investigation findings that 1MDB funds benefited a motion picture company.

The Swiss Office of the Attorney-General has said it has "elements in hand" to suspect the US$3.5 billion 1MDB paid to a British Virgin Island firm benefited "a company related to the motion picture industry".

"There has never been anything inappropriate about any of Red Granite pictures or Riza Aziz's business activities.

"What they have done and will continue to do is develop and produce successful and acclaimed movies that have generated more than US$825 million in worldwide box office revenues," a Red Granite spokesperson told the Finance Times .

The Swiss OAG is investigating the flow of funds from the US$3.5 billion payment made by 1MDB to Aabar BVI (British Virgin Islands), as part of the Genting Tanjong power plant purchase.

The OAG said it believes the funds instead benefited a "former 1MDB body" and two Emirati officials related to the Abu Dhabi state funds, International Petroluem Investment Corporation and Aabar.

1MDB said it transferred the funds to Aabar BVI after being told by then IPIC managing director Khadem al Qubaisi and Aabar chairperson Mohamed Al Husseiny that the BVI firm is an IPIC subsidiary.

However, IPIC told the London Stock Exchange on Monday that it does not own Aabar BVI.

Red Granite told the New York Times its principal investor is Abu Dhabi businessman Mohamed Ahamd Badawi Al-Husseiny.

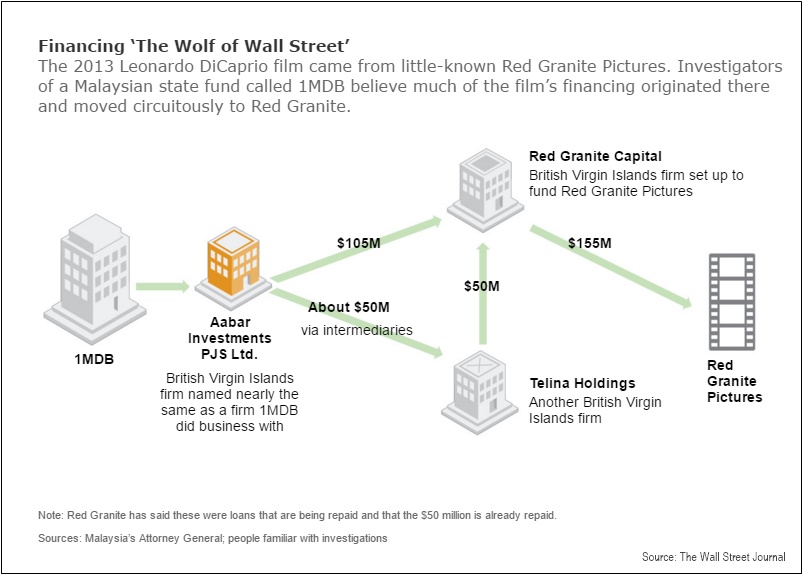

The Wall Street Journal reported US$155 million of 1MDB funds went into making the Hollywood hit 'The Wolf of Wall Street'. 1MDB denies this.

A sum of US$105 million of that came from a loan from Aabar BVI, The Wall Street Journal reported, citing investigation documents.

Red Granite did not respond to the specifics in The Wall Street Journal report but said it has no reason to suspect irregularities in the financing. The firm is also cooperating with investigations, a spokesperson was quoted as saying.