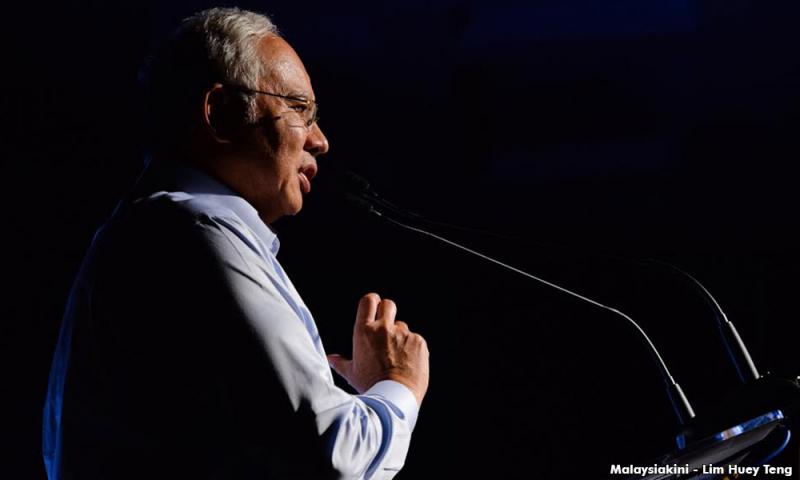

Malaysians may be wondering why a tiny European country is joining the growing global investigation into 1MDB, but the outcome of the Luxembourg probe could have great bearing on Prime Minister Najib Abdul Razak.

To begin with, the Luxembourg investigation does not indicate that it has anything to do with Najib.

But the Luxembourg probe is significant as it may solve an important missing link - the connection between 1MDB and a number of entities which have generously pumped billions of ringgit, claimed to be donations, into Najib's personal bank accounts.

ABC News on Tuesday, citing Najib's bank records, revealed that US$1.051 billion (RM4.2 billion) in the prime minister's personal accounts originated from entities such as Saudi Arabia's Ministry of Finance, Prince Faisal bin Turkey bin Bandar Alsaud, Tanore Finance (BVI) and Blackstone Asia Real Estate Partners Ltd (BVI).

The Prime Minister's Office claimed the Saudi entities are proof of what Najib had always asserted - that the money was a Saudi donation and any links to 1MDB is wrong.

So how is this related to the Luxembourg investigation?

The Wall Street Journal today reported that the Luxembourg unit of Banque Privee Edmond De Rothschild Group, which manages funds for wealthy clients, confirmed it was cooperating with the country's investigators who are determining whether 1MDB's funds flowed into the private bank.

However, even before the Luxembourg authorities made public their investigation, Sarawak Report had in January zoomed in on Banque Privee Edmond De Rothschild.

In particular, the whistleblower portal released documents showing that Khadem Al-Qubaisi's Luxembourg account at Banque Privee Edmond De Rotschilde, held under the name of ‘The Vasco Trust’, received US$472.75 billion (RM1.84 billion) in deposits between May 29, 2012 and Dec 4, 2012.

The money originated from Blackstone Asia Real Estate Partners Ltd (BVI), the same offshore company which had pumped at least US$120 million (RM480 million) into Najib's personal bank accounts between Jan 3, 2012 and May 23, 2012.

Khadem was formerly the chairperson of Aabar Investments PJS, the subsidiary of Abu Dhabi sovereign wealth fund International Petroleum Investment Company (IPIC), of which he was also managing director. Both entities have business dealings with 1MDB.

Five transactions

The Luxembourg probe is believed to be centred around Khadem's account in Banque Privee Edmond De Rotschilde.

This was based on the fact that the Luxembourg state prosecutor's statement said investigators "aim to trace the origin of four transfers in 2012" which corroborates with the four transactions first highlighted by Sarawak Repor t in January.

The four transactions Khadem received from Blackstone Asia Real Estate Partners Limited (BVI) over a seven-month period began with a US$158 million deposit on May 29, 2012 and subsequently another US$100.75 million, US$129 million and US$85 million were transferred on Aug 3, Oct 31 and Dec 4 respectively, totalling US$472.75 million.

The Luxembourg state prosecutor's statement added that investigators were also tracing the origin of another transaction in 2013, which appeared to refer to a US$20.75 million deposit Khadem received on Feb 2 that year from Good Star Limited, also highlighted by the whistleblower portal in January.

Good Star Limited was controlled by Najib's associate and Penang-born billionaire Jho Low. The company was accused of siphoning off US$1.030 billion from 1MDB's joint-venture with PetroSaudi International, but 1MDB had insisted all its funds in the deal was accounted for.

As the Luxembourg investigation will look into whether 1MDB's fund flowed into Khadem's Banque Privee Edmond De Rotschilde account, it would mean establishing the source of Blackstone Asia Real Estate Partners Limited (BVI) and Good Star Limited's funds which were responsible for the five deposits.

Ultimately, determining whether Blackstone Asia Real Estate Partners Limited's (BVI) got the funds it sent to Khadem from 1MDB, or not, will have a bearing on Najib. In other words, it would be a test on Najib's assertion that the multi-billion ringgit deposits he received had always been a donation and is not linked to 1MDB.

And as for Good Star Limited, the facts established by the Luxembourg investigation will also help shed light if 1MDB was truthful that its aborted joint-venture with PetroSaudi International was above board or whether allegations that US$1.030 billion of 1MDB's funds was siphoned by the company held merits.

Sarawak Report in an article today also noted that the Luxembourg state prosecutor's statement said its investigation of the five transactions is in the context of the issuance of two bonds in May and October 2012.

The timeline corresponds with the two bonds of US$1.75 billion each, totalling US$3 billion, which 1MDB had raised to acquire power assets.

These were the same bonds which Goldman Sachs underwrote and charge over US$300 million, or a staggering 10 percent, and which is now under investigation in the US.

The UAE investigation

But the Luxembourg probe, in the context of the bonds, has more to do with yet another investigation on 1MDB taking place in the United Arab Emirates (UAE).

In September last year, The Wall Street Journal reported that US$2.4 billion 1MDB was supposedly to pay to Aabar Investments PJS, the subsidiary of Abu Dhabi's IPIC, never arrived.

The money 1MDB had to pay were the conditions set out in exchange for IPIC guaranteeing the US$3.5 billion bonds the Malaysian sovereign wealth fund it was raising.

Under the deal with IPIC, 1MDB would allow the Abu Dhabi sovereign wealth fund to keep US$1.4 billion of its US$3.5 billion bonds as security deposit.

1MDB would also give IPIC's subsidiary Aabar Investments PJS a 49 percent option to subscribe to the former's power assets subsidiaries, which 1MDB later terminated for around US$1 billion.

But the Abu Dhabi sovereign wealth fund never received the total of US$2.4 billion, so where did the money go?

The Wall Street Journal in December reported that at least US$850 million of this money was paid to Aabar Investments PJS Ltd, registered in the British Virgin Islands (BVI), which carried a similar name to IPIC's subsidiary.

This company, though having a similar name to IPIC's subsidiary Aabar Investments PJS, was not owned by IPIC. Instead, it was incorporated by Khadem and Mohammed Al-Husseiny, who was also the chief executive officer of the "real" Aabar and have since been removed, according to Sarawak Report .

The whistleblower portal speculated that the Aabar PJS Ltd (BVI) may be linked to Blackstone Asia Real Estate Partners Ltd (BVI), in the context of the Luxembourg authorities probing the 1MDB bonds and Khadem's Banque Privee Edmond De Rothschild account.

If the Luxembourg authorities do establish such a link, then the 'donation' saga may prove to be more than just a 'donation' and may well pile pressure on the Malaysian attorney-general to reopen the case.