The proposal to remove sugar from the list of controlled price items and expand the scope of Sugar-Sweetened Beverage (SSB) taxation through the 2025 Budget is a timely and effective measure to address the escalating public health crisis of non-communicable diseases (NCDs) in Malaysia.

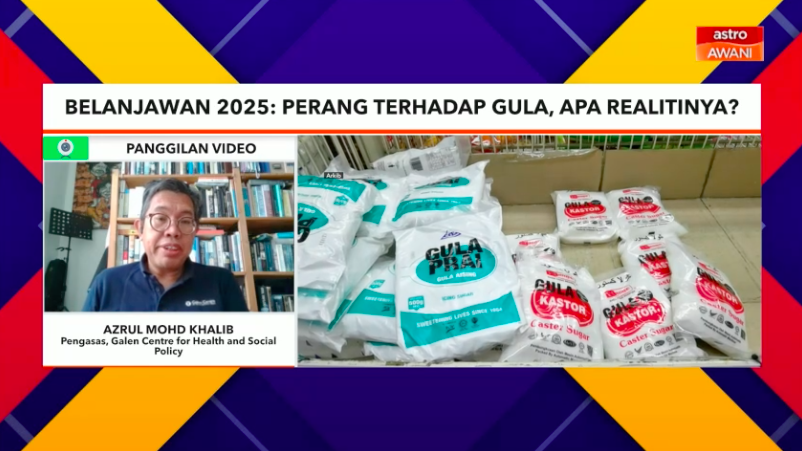

As highlighted by the Galen Center for Health and Social Policy in ASTRO Awani recently, the current approach of merely increasing SSB taxes is insufficient to curb the consumption of sugary drinks, even going on to state that sweetened condensed milk used in restaurants and eateries should also be listed in the new scope of taxation.

It is a known fact that the consumption of sugary drinks by consumers in Malaysia should not be merely measured in terms of carbonated water or canned drinks when it is actually a drink that is brewed in restaurants and eateries such as teh tarik, iced coffee, rosemilk syrup, fruit juice loaded with sugar water and so on.

The intake of sugar through drinks that are brewed especially in the 'mamak' roadside stalls are much higher compared to canned drinks that come out of the factories, hence it is difficult to exercise any control.

The continued control of sugar prices through subsidies has not only perpetuated the consumption of sugary drinks but has also placed a significant burden on public finances with the government's expenditure on sugar subsidies, estimated to be over RM600 million per year, diverts resources away from essential health services, including the treatment of NCDs. This is particularly concerning given the rising costs associated with managing diseases such as diabetes, cardiovascular disease, high blood pressure, kidney disease and even cancer.

Treatment for diabetes and other metabolic cardio-renal diseases such as kidney ailments costs more than RM3 billion a year. Therefore, the withdrawal of sugar subsidies for the producers is deemed a reasonable action in line with the concept of 'war against sugar'.

The government has been spending the SSB tax revenue amounting to RM330 million as part of the subsidy to sugar producers while spending more money to ensure the price of sugar stays cheap.

The only way to ensure that the 'war against sugar' as declared recently is effective and successful, is for the government to eliminate sugar as a controlled item.

The sugar subsidy was initially supposed to be abolished in October 2013. However, due to the fact that sugar prices continue to be controlled and is not determined by the consumer market, the government has been forced to provide subsidies to the sugar producers from November 2023; with a publicly-funded subsidy amount of RM1.00 per kilogram for raw and refined sugar amounting to approximately RM42 million monthly.

Currently, sugar is still listed as one of the goods under the Price Control and Anti-Profitability Act 2011, making the war against sugar a difficult one.

Removing sugar from the list of controlled price items would have several advantages including allowing sugar prices to be determined by market forces hence encouraging more efficient production and distribution, potentially leading to lower prices for consumers in the long term and reducing the government's role in the sugar market while freeing up resources for other priorities.

The revenue generated from SSB taxation should be allocated directly to the Ministry of Health (MoH) to support the treatment of NCDs.

While taxation and price controls can be effective tools to discourage sugar consumption, it is essential to address the underlying factors contributing to NCDs, starting with encouraging the Malaysian consumers to indulge in less sugared drinks ordered from eateries which must be continuously done through education and public health campaigns.

The views expressed here are those of the author/contributor and do not necessarily represent the views of Malaysiakini.

Interested in having your press releases, exclusive interviews, or branded content articles on Malaysiakini? For more information, contact [email protected] or [email protected]