The impact Covid-19 has wreaked on businesses is unprecedented. Trade groups have repeatedly painted a bleak picture of businesses, especially small and medium-sized enterprises (SMEs), struggling for survival because of Covid-19 and the various iterations of the Movement Control Order (MCO) imposed to curb its spread.

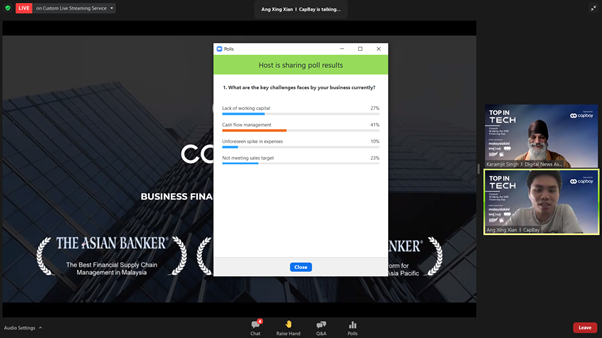

In a poll conducted during a recent webinar titled “Fintech: Bridging the SME Financial Gap”, cash flow management emerged as the top key challenge currently faced by businesses (cited by 41% of respondents), followed by lack of working capital (27%), not meeting sales targets (21%), and an unforeseen spike in expenses (10%).

In parallel, a survey conducted last year by Ernst & Young, on the impact of Covid-19 and the various forms of MCO on businesses revealed that the top challenges faced by Malaysian businesses are cash flow, liquidity, delays in receivables, and declines in revenue. Some 51% of large and listed companies and 41% of SMEs surveyed experienced delays in receivables, 21% and 28% experienced a delay in payment to vendors respectively, and 10% and 11% saw a shortfall in liquidity.

Indeed, cash flow has become a nagging issue for many. Long payment terms from clients coupled with the sharp decline in sales further challenge the liquidity position of businesses. SME Association of Malaysia in an August 2020 survey covering 1,713 members found 22% of the respondents saying they have sufficient cash flow to last them only a month, while 27% and 31% can sustain up to three to four months respectively.

Theoretically, the cash gap can easily be addressed by taking on additional financing but banks are often less than enthusiastic in providing financing to SMEs during bleak times. Moreover, banks typically take about 1 to 3 months to process an application depending on the complexity of the case.

Introducing CapBay - helping you free more cash flow from your Supply Chain ecosystem

CapBay, an SC-approved home-grown Multibank Supply Chain Finance and Peer-to-Peer (P2P) financing platform offers Supply Chain Financing solutions that can help SMEs in every phase of their business to thrive and withstand the impact of the Covid-19 pandemic.

The Malaysian fintech was recognised as the leader in Supply Chain Finance at “The Asian Banker Award 2018”, which honours technological achievements spanning across Asia Pacific and the Middle East. Here, they bagged two awards namely “The Best Fintech Platform - Digital Supply Chain Finance in Asia-Pacific'' and “The Best Financial Supply Chain Management in Malaysia”. CapBay was also recently named the “Fintech Startup of the Year” at “The Asset Triple A Digital Awards 2020” and was the first Malaysian fintech to win such a prestigious award.

Helping you to unlock a world of cash flow for your business via Invoice Financing

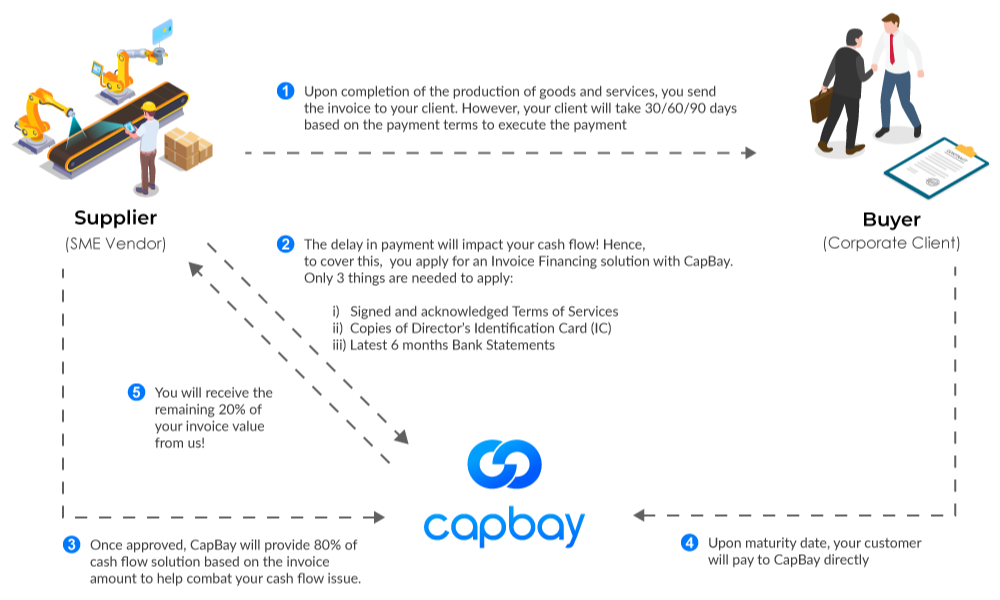

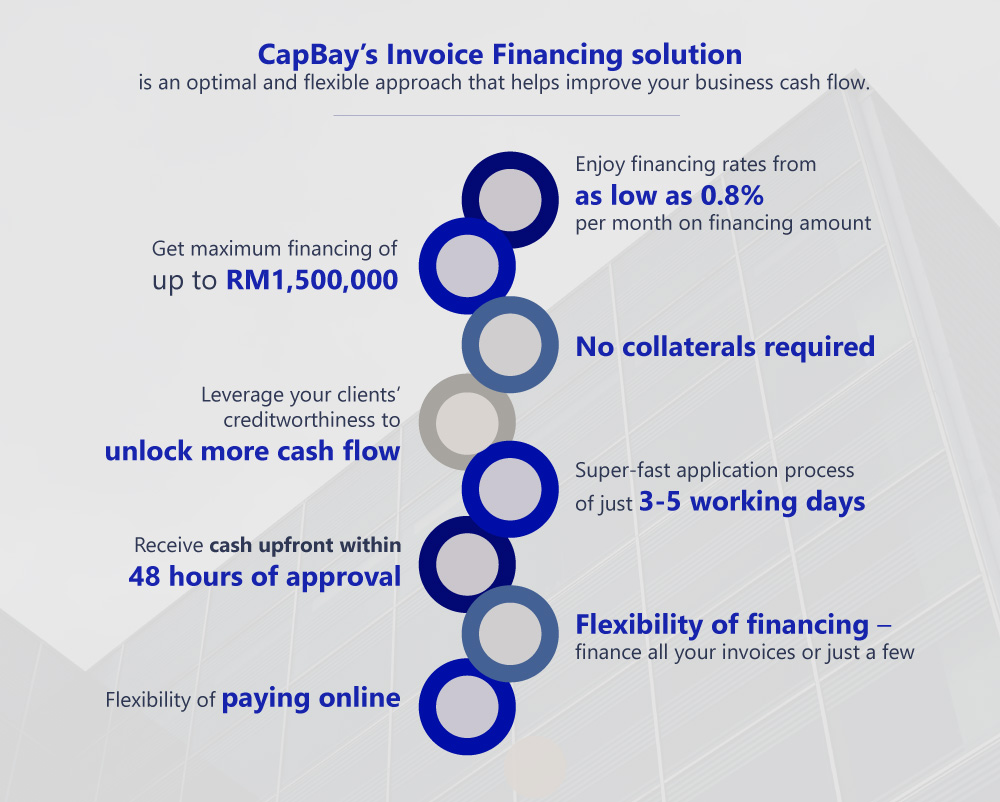

CapBay’s Invoice Financing solution is an optimal and flexible approach that helps improve your business cash flow. You can instantly get an upfront payment based on your invoice amount. No longer do you need to worry about the long payment terms from your customers. Achieve full control of your receivables without any worry.

Other than Invoice Financing, CapBay also offers SMEs a complete suite of working capital financing solutions that can be tailored to your business needs. You can get in touch with CapBay here.

Getting financing should not be hard. To make financing easy, CapBay requires your business to meet only a few simple criteria as follows to apply for its solution:

-

Has been in operation for at least 1 year

-

Your business is providing services or goods to other Malaysian businesses on credit terms (B2B)

-

You’re a Malaysian registered business, with at least 51% local shareholding

CapBay’s Referral Programme

You can also earn extra cash by participating in CapBay’s Referral Programme. Simply refer an SME and be rewarded with RM300 cash!

The new normal demands a new way of managing and financing your business. Use this opportunity wisely to turn your business around and maintain a healthy cash flow despite the challenges. Click for more information on CapBay’s smart financing solutions for SMEs.