In the constantly-evolving and dynamic world of finance, the significance of Environmental, Social and Governance (ESG) investing has emphatically gained momentum, said Chiang Kang Pey, Chief Executive Officer of Public Mutual Bhd.

This, he pointed out, is not unexpected as sustainability has indeed become a key focus in a world faced with environmental and social issues such as global warming, climate change and the Covid-19 health pandemic.

“Policymakers around the world have been actively pushing the ESG agenda, with regulators requiring listed companies to adopt more stringent ESG practices and increase sustainability reporting disclosures,” he added.

According to Chiang, while conventional unit trusts are collective investment schemes managed by professionals, which pool contributions from multiple investors to purchase a portfolio of securities, ESG investing adds on an ESG overlay to identify investments that meet environmental, social, and governance criteria while aiming to generate returns.

Essentially, ESG funds attract investors seeking sustainable investments with both financial and environmental/community impacts in mind. Through ESG investing, investors can influence companies' sustainability practices by excluding poorly-rated companies from their portfolios.

“ESG factors also serve as a risk management tool, as low ESG rankings can lead to various risks affecting a company's future returns, such as litigation, labour strikes, fraud, governance issues and negative publicity, making ESG considerations crucial for informed investment decisions,” he explained.

Chiang revealed that, Public Mutual currently has two retail ESG funds, i.e. Public e-Islamic Sustainable Millennial Fund (PeISMF) and Public e-Carbon Efficient Fund (PeCEF), as well as one wholesale ESG fund, i.e. Public e-Wholesale Sustainable 20 Fund (PeWS20F).

“We adopt positive screening for these three funds by selecting ESG-qualified securities from the constituents of global ESG indices. In addition, PeCEF also adopts thematic investing by investing primarily in companies with efficient carbon footprints,” he added.

IMPACT

According to Morningstar's analysis of 4,900 funds, 58.8% of ESG funds outperformed traditional funds over a 10-year period until 2019. ESG funds also showed higher survivorship rates, indicating fewer closures compared to traditional funds.

Academic and industry studies suggest that companies with strong ESG practices have lower capital costs, reduced stock price volatility and fewer instances of corruption, resulting in better risk-adjusted returns. The increasing demand for ESG investing may also lead to a valuation premium for companies with higher ESG ratings, potentially improving share price performance.

“With regard to Public Mutual’s own experience, the net asset values (NAVs) of PeISMF and PeCEF have grown to RM321.29 million and RM479.41 million respectively since their respective commencement dates of 25 November 2019 and 1 March 2021 up to end-June 2023. PeWS20F, which commenced operations only a year ago on 25 July 2022, has seen its NAV expanding to RM16.60 million as at end-June 2023,” said Chiang.

This has brought the aggregate NAV of Public Mutual’s sustainable and responsible investment (SRI) funds under management to RM817.30 million as at end-June 2023. For the year-to-date period ended 30 June 2023, PeISMF, PeCEF and PeWS20F have generated positive returns of +28.39%, +27.30% and +20.87% respectively.

“Since their respective commencement dates, PeISMF, PeCEF and PeWS20F have registered total returns of +66.69% (+15.26% in annualised terms), +15.54% (+6.39% in annualised terms) and +16.58% respectively as at end-June 2023,” he revealed.

CURRENT MARKET TRENDS

ESG investing will continue to play a crucial role in financing green and sustainability projects, especially for capital-intensive climate transition infrastructure. It serves as a bridge between traditional and sustainable financing for businesses striving to achieve net-zero emissions.

ESG ratings are instrumental in evaluating the performance of investee companies and help investors incorporate ESG considerations into their investment strategies. Meanwhile, investors may actively engage with companies to promote the adoption of improved ESG practices and enhance the quality of ESG disclosures.

“As part of Public Mutual’s ESG investing strategy, we may engage with investee companies when concerns on their low ESG ratings or ESG issues have been identified,” said Chiang.

Globally, the monies of ESG funds are generally invested in assets with an accepted level of ESG standard and reasonable risk-adjusted returns to strike a balance between corporate responsibility and returns.

“In general, Public Mutual’s SRI funds are invested in global ESG-qualified companies which adopt and/or promote sustainable practices such as decarbonisation, carbon efficiency and renewable energy utilisation,” he added.

FUTURE

According to Global Sustainable Investment Review 2020, global sustainable investment assets have grown significantly from US$11.4 trillion in 2012 to US$35.3 trillion in 2020, with projections to reach US$50 trillion by 2025. This growth highlights the increasing importance of environmental and social practices for investors.

Companies excelling in ESG adoption may receive rewards for their focus on sustainability and risk management, potentially leading to better risk-adjusted returns in ESG portfolios. However, challenges remain, including the lack of standardisation in ESG disclosures and the risk of greenwashing.

To address these issues, Chiang said that Public Mutual’s internal ESG evaluation provides an alternative measurement of companies’ ESG performance, especially for potential investee companies which are not rated by third-party ESG rating service providers.

“Our internal ESG evaluation can also complement third-party ESG ratings which may not be up to date as the latter is only updated semi-annually. All in all, we believe that the transition towards achieving full sustainability targets is ongoing and will continue to improve in the foreseeable future,” he added, reiterating Public Mutual’s focus to ESG investing.

Thus far, PeISMF has received two prestigious awards: the Best Low Carbon (Silver) Award at The Edge ESG Awards 2022 and the 3-Year Fund Award in Equity Global - Malaysia Islamic Funds at Refinitiv Lipper Fund Awards 2023. Similarly, PeCEF won the Best in E, S & G - Environment (Gold) Award at The Edge ESG Awards 2022.

“These awards acknowledge the funds' outstanding commitment to ESG principles and their impressive performance in the financial markets,” he concluded.

HOW TO GET STARTED WITH INVESTMENTS IN UNIT TRUSTS?

Prior to making any investments in unit trusts, it is important to remember that unit trusts are not get-rich-quick schemes. Past performance of a fund is also not a guarantee of its future performance as no one can predict how the markets will behave.

Prospective investors should create an investment plan that aligns with their financial goals before they start investing.

They also need to take a Suitability Assessment to figure out their risk profile and determine the level of risk they are comfortable with in order to develop a portfolio that matches their risk tolerance.

To begin investing, the prospective investor will need to open a unit trust investment account with a unit trust management company (UTMC) such as Public Mutual. With Public Mutual, they can visit the Company’s headquarters, any of our 31 branches and customer service centres nationwide, or contact our unit trust consultants (UTCs).

Prospective investors can also enrol as a new investor through Public Mutual’s corporate website and start investing via the Company’s dedicated online platform, Public Mutual Online (PMO).

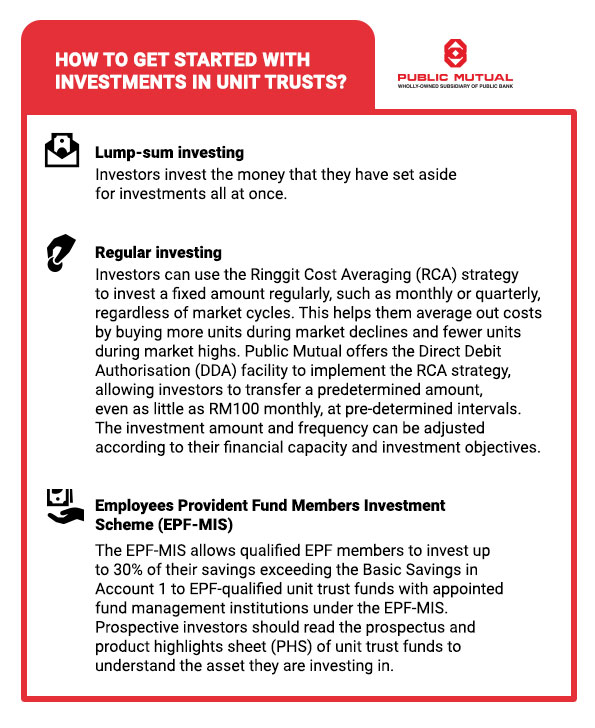

Once they have opened their investment account, they have the option to invest through:

Lump-sum investing – Investors invest the money that they have set aside for investments all at once.

Regular investing – Investors can use the Ringgit Cost Averaging (RCA) strategy to invest a fixed amount regularly, such as monthly or quarterly, regardless of market cycles. This helps them average out costs by buying more units during market declines and fewer units during market highs. Public Mutual offers the Direct Debit Authorisation (DDA) facility to implement the RCA strategy, allowing investors to transfer a predetermined amount, even as little as RM100 monthly, at pre-determined intervals. The investment amount and frequency can be adjusted according to their financial capacity and investment objectives.

Employees Provident Fund Members Investment Scheme (EPF-MIS) – The EPF-MIS allows qualified EPF members to invest up to 30% of their savings exceeding the Basic Savings in Account 1 to EPF-qualified unit trust funds with appointed fund management institutions under the EPF-MIS. Prospective investors should read the prospectus and product highlights sheet (PHS) of unit trust funds to understand the asset they are investing in.

Disclaimer

Investors are advised to read and understand the contents of the relevant Prospectuses, Supplemental Prospectuses, Information Memorandum and Product Highlights Sheet (PHS) before investing.

Investors should understand, compare and consider the risks, fees, charges and costs involved in investing in a fund. A copy of the Prospectus, Supplemental Prospectus, Information Memorandum and Product Highlights Sheet (PHS) can be viewed at Public Mutual’s website www.publicmutual.com.my.

Past performance of a fund is not an indication of its future performance. Investors should make their own assessment of the merits and risks of the investment. If in doubt, investors should seek professional advice. Investors are advised to refer to Public Mutual’s website www.publicmutual.com.my for their latest investment disclaimer.