KINIGUIDE | In the US Department of Justice’s recent filings related to the 1MDB scandal, among the relevant individuals named in the suit are ‘1MDB Officer 1’, ‘1MDB Officer 2’, and ‘1MDB Officer 3’.

Like the much-reported ‘Malaysian Official 1’ in the document, the names of these other 1MDB officers are also concealed throughout the document.

And yet, there are tantalising clues throughout the 136 pages of the DOJ document.

Thus far, little attention has been given to the identities of these 1MDB officers.

In this instalment of KiniGuide, we look back at the history of the 1MDB scandal in an attempt to shed some light on this mystery, as well as on several others who have not been identified by name in the court filings.

1MDB Officer 1

“1MDB OFFICER 1 is a Malaysian national who served as the executive director of 1MDB from the time of its creation until approximately March 2011.”

The court filings state that 1MDB Officer 1 had served as Terengganu Investment Authority’s (TIA) executive director of business development, and later became 1MDB’s executive director. Casey Tang Keng Chee is the only person who fits the description.

TIA is 1MDB’s predecessor until it was taken over by the federal government and rebranded as 1MDB in 2009.

Tang, 51, was sought by Bank Negara Malaysia in July last year in connection with an investigation under the Exchange Control Act 1953.

Tang, 51, was sought by Bank Negara Malaysia in July last year in connection with an investigation under the Exchange Control Act 1953.

A Facebook post by the central bank listed Tang’s full name, identity card number and last known address, and appealed to members of the public for information on his whereabouts.

The US Department of Justice filing alleged that 1MDB Officer 1 had misled banks and concealed certain facts from 1MDB’s board of directors in order to transfer US$700 million to Good Star Ltd, which in turn is supposedly owned by the Penang-born businessman Low Taek Jho (also known as Jho Low).

1MBD Officer 2

“1MDB OFFICER 2 is a Malaysian national who served as 1MDB’s chief executive officer (‘CEO’) between at least 2009 and 2013.”

1MDB’s chief executive during this period was Shahrol Azral Ibrahim Halmi, who held the post until March 2013, which means that ‘1MDB Officer 2’ refers to him.

Many of the most significant deals of 1MDB took place under this Stanford University graduate’s watch, including TIA’s issuance of RM5 billion in Islamic Medium Term Notes, the transfers totalling US$1.3 billion from 1MDB to Low’s Good Star Ltd, the acquisition of power assets worth billions of ringgit, and more.

While helming TIA as its CEO, Shahrol (photo) had disregarded its board’s directions to suspend the issuance of the RM5 billion notes and was briefly sacked from his post, although he was later reinstated, notes the Public Accounts Committee report on 1MDB.

While helming TIA as its CEO, Shahrol (photo) had disregarded its board’s directions to suspend the issuance of the RM5 billion notes and was briefly sacked from his post, although he was later reinstated, notes the Public Accounts Committee report on 1MDB.

According to the US Department of Justice, Shahrol had misled banks and 1MDB’s board of directors into believing that Good Star Ltd is owned by PetroSaudi International, and not by Jho Low.

1MDB Officer 3

“1MDB OFFICER 3 is a Malaysian national who served as 1MDB’s general counsel and executive director of group strategy during, at a minimum, 2012 and 2013. 1MDB OFFICER 3 was a main point of contact between 1MDB and Goldman in connection with the three Goldman-underwritten bond offerings in 2012 and 2013.”

Jasmine Loo Ai Swan, 43, was previously 1MDB’s general counsel and executive director of group strategy, and a likely candidate for ‘1MDB Officer 3’. Like Tang, Bank Negara had made a public appeal for her whereabouts in July last year.

According to the US Department of Justice, some US$1.367 billion had been siphoned from 1MDB during the ‘Aabar-BVI’ phase of the supposed embezzlement.

Of these, about US$5 million ended up in a bank account in Zurich, Switzerland, on Dec 6, 2012, which was held under the name of ‘River Dee International SA’. 1MDB Officer 3 is alleged to be the account’s actual owner.

The court filings also state that 1MDB Official 3 is an authorised signatory of a bank account held in the name of Tanore Finance Corporation.

This account was used during March 2013 to transfer US$681 million to an Ambank account held by a certain ‘Malaysian Official 1’, of which US$620 million was returned around Aug 26 that year.

Two non-Malaysians also named

The US Department of Justice’s filings had directly implicated five people as ‘relevant individuals’ in the case, three of them being Malaysians: Jho Low, Prime Minister Najib  Abdul Razak’s stepson Riza Aziz (photo) and Low’s associate, Eric Tan Kim Loong.

Abdul Razak’s stepson Riza Aziz (photo) and Low’s associate, Eric Tan Kim Loong.

The two non-Malaysians are Khadem Abdulla al-Qubaisi, a United Arab Emirates national who was the International Petroleum Investment Company’s (IPIC) managing director and Aabar Investments PJS’ chairperson, and Mohamed Ahmed Badawy al-Husseiny, a US national who was Aabar PJS’ chief executive.

Both were also directors in the British Virgin Islands-based Aabar Investments PJS Ltd (Aabar-BVI).

Khadem Abdulla al-Qubaisi

“Khadem Abdulla Al QUBAISI (‘QUBAISI’), a UAE national, was the managing director of IPIC from 2007 to 2015 and the chairman of Aabar in at least 2012 and 2013… QUBAISI also was a director of Aabar-BVI.”

According to Reuters, Khadem, 45 (on left in photo), joined the Abu Dhabi Investment Authority in 1993, in the same year that he graduated with a bachelor’s degree in economics, and was transferred to IPIC in 2000 to become its investment manager.

According to Reuters, Khadem, 45 (on left in photo), joined the Abu Dhabi Investment Authority in 1993, in the same year that he graduated with a bachelor’s degree in economics, and was transferred to IPIC in 2000 to become its investment manager.

He was appointed as IPIC’s managing director in May 2007, but was abruptly replaced in April last year amid the 1MDB scandal, and he resigned from various board and management positions in the UAE and throughout the region in the following months.

On April 2 this year, the UAE government froze the assets of Khadem and Badawy and their bank accounts, and banned them from travelling abroad pending investigations on their dealings with 1MDB.

Mohamed Ahmed Badawy al-Husseiny

“Mohamed Ahmed Badawy Al-HUSSEINY (‘HUSSEINY’), a US citizen, was the CEO of Aabar from 2010 to 2015. He was also a director of Aabar-BVI.”

Khadem and Badawy hold key positions in both Aabar Investments PJS and Aabar Investments PJS Ltd.

Despite the names differing only by three letters, the latter British Virgin Islands (BVI) company is not a subsidiary of 1MDB’s business partner IPIC, unlike Aabar Investments PJS.

The court filings allege that in May and October 2012, Goldman Sachs International raised a total of US$3.5 billion through bond issuances for 1MDB, codenamed ‘Project Magnolia’ and ‘Project Maximus’. Of these, US$1.367 billion ended up with the Aabar-BVI.

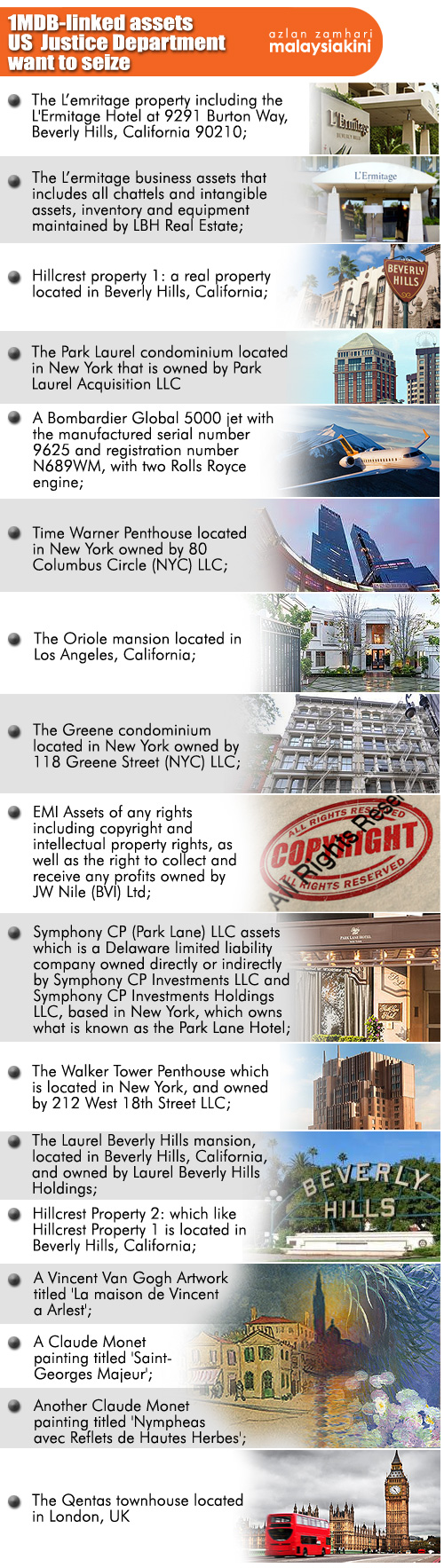

After several transfers, the money eventually ended up in the bank accounts of Khadem, Badawy and several others, some of which were used to buy high-end real estate.

The US Department of Justice claimed that Aabar-BVI was created and named such to create a false impression that it is associated with Aabar Investments PJS, although in reality, Aabar-BVI has no genuine relationship with either Aabar nor IPIC.

“Plaintiff alleges on information and belief that the Aabar-BVI Swiss (bank) account was used to conceal and to facilitate this unlawful diversion of funds,” it said.

Who is “Malaysian Official 1’?

“MALAYSIAN OFFICIAL 1 is a high-ranking official in the Malaysian government who also held a position of authority with 1MDB.

“During all times relevant to the complaint, MALAYSIAN OFFICIAL 1 was a ‘public official’ as that term is used in 18 U.S.C. § 1956(c)(7)(B)(iv) and a ‘public servant’ as that term is used in Section 21 of the Malaysian Penal Code.”

Following the US Department of Justice’s filing of its civil forfeiture suit in relation to the 1MDB scandal, speculation has been rife about the identity of ‘Malaysian Official 1’ listed in the suit.

According to the filings, Malaysian Official 1 is a relative of Riza Aziz and held a key position in 1MDB since it was founded. Any 1MDB financial commitments that would likely affect the Malaysian government’s policies or guarantees would require his approval.

In addition, the filings claim that the largest transfer to the bank account of Malaysian Official 1 was a March 2013 transaction of US$681 million to an AmBank account.

The description of the transactions match those in Malaysian attorney-general Mohamed Apandi Ali’s Jan 26 press statement regarding the findings of investigations into Prime Minister Najib Abdul Razak’s RM2.6 billion donation scandal and transfers from the 1MDB-linked company SRC International.

Najib is Riza’s stepfather, and is also the prime minister and finance minister of Malaysia. He was the head of 1MDB’s advisory board until the board was abolished this year.

Najib has consistently denied any wrongdoing in the 1MDB matter, and assured his cooperation with international investigators in the interest of good governance.

Apandi also noted that Najib was not named in the lawsuits.

Responding to a question, US attorney-general Loretta E Lynch said the lawsuits only named those the department needed to name to meet the objectives of seizing the various assets.

This instalment of KiniGuide was compiled by Adrian Wong, translated by Koh Jun Lin.

Related KiniGuides

A spicy Kari and a US$1 billion suit

The unmaking of the 143-year-old bank BSI

Your KiniGuide on the OSA and how not to get arrested