The US Department of Justice (DOJ) has detailed in its lawsuit what it described as the "three principal phases" of money-laundering through the troubled Malaysian state fund 1MDB.

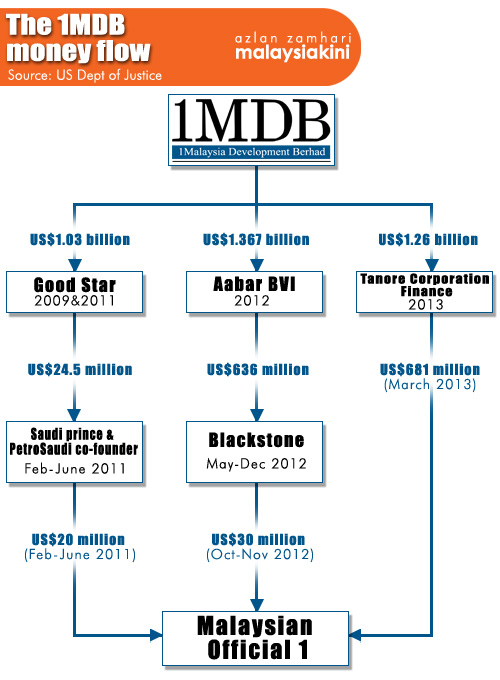

The first phase is called the 'Good Star phase', the second phase is the 'Aabar BVI phase' and the third phase is the 'Tanore phase'.

Under the Good Star phase, the DOJ said that more than US$1 billion were fraudulently diverted from 1MDB.

"Between 2009 and 2011, under the pretense of investing in a joint venture between 1MDB and PetroSaudi International, a private Saudi oil extraction company, officials of 1MDB and others arranged for the fraudulent transfer of more than US$1 billion from 1MDB to a Swiss bank account held in the name of Good Star Limited," the lawsuit states.

One of the ways 1MDB officials achieved this diversion of funds was by providing false information to banks about the ownership of Good Star, it said.

"Contrary to representations made by 1MDB officials, the Good Star account was beneficially owned not by PetroSaudi or the joint venture, but by Low Taek Jho, aka Jho Low, a Malaysian national who had no formal position with 1MDB but was involved in its creation," it said.

Low (photo), it added, had laundered more than US$400 million of the misappropriated funds from 1MDB through Good Star into the US, after which the funds were used for "the personal gratification" of Low and his associates.

Low (photo), it added, had laundered more than US$400 million of the misappropriated funds from 1MDB through Good Star into the US, after which the funds were used for "the personal gratification" of Low and his associates.

Following that was the Aabar BVI phase, where the DOJ alleged that approximately US$1.367 billion was misappropriated from 1MDB.

The US$1.367 billion were a portion of the proceeds that 1MDB raised through two separate bond offerings arranged and underwritten by Goldman Sachs International in 2012, according to the lawsuit.

The bonds were guaranteed by both 1MDB and International Petroleum Investment Company (IPIC), it added.

"Beginning almost immediately after 1MDB received the proceeds of each of these two bond issues, 1MDB officials caused a substantial portion of the proceeds - approximately US$1.367 billion, a sum equivalent to more than 40 percent of the total net proceeds raised - to be wire transferred to a Swiss bank account belonging to a British Virgin Islands entity called Aabar Investments PJS Limited (Aabar BVI)," the lawsuit read.

Aabar BVI had been created and named to give the impression that it was associated with Aabar Investments PJS (Aabar), a subsidiary of IPIC, though in reality there is no affiliation between Aabar BVI with Aabar or IPIC, it said.

"The Swiss bank account belonging to Aabar BVI was used to siphon off proceeds of the 2012 bond sales for the personal benefit of officials at IPIC, Aabar and 1MDB and their associates," it said.

The funds diverted, it added, were transferred to, among other places, a Singapore bank account controlled by Eric Tan, an associate of Low.

Those funds were then distributed for the personal benefit of various individuals, including officials at 1MDB, IPIC or Aabar, the document reads.

'Complex series of transactions'

After that came the Tanore phase, where DOJ said that several individuals, including 1MDB officials, had in 2013 diverted more than US$1.26 billion out of a total of US$3 billion that 1MDB had raised through a third bond offering from Goldman Sachs.

The proceeds of this bond offering were supposed to fund a joint venture between 1MDB and Aabar, called the Abu Dhabi Malaysia Investment Company (Admic), the lawsuit said.

However, days after the bond sale, a significant portion of the proceeds was instead diverted to a Singapore bank account held by Tanore Finance Corporation, in which Tan was the recorded beneficial owner, it said.

"Although the Tanore account had no legitimate connection to 1MDB, the then executive director of 1MDB was an authorised signatory on the account.

"1MDB funds transferred into the Tanore account were used for the personal benefit of Low and his associates, including officials at 1MDB, rather than for the benefit of 1MDB or Admic," the document reads.

The DOJ said that the proceeds of each of these phases were laundered through a complex series of transactions, including through bank accounts in Singapore, Switzerland, Luxembourg and the US.

Numerous assets were acquired with these funds that were unlawfully diverted from 1MDB or could be traced to the state fund, it said.

As such, it explained, the assets are subject to forfeiture under US laws.

The DOJ had earlier filed the lawsuit in Los Angeles, seeking to seize assets located in US and abroad, including in the UK and Switzerland, as they alleged that the assets were involved in money laundering.

The assets include mansions, artwork, a private jet and gambling debt in Las Vegas casinos.

Other than Low, the lawsuit also named Prime Minister Najib Abdul Razak's stepson Riza Aziz and two Abu Dhabi government officials.

The two Abu Dhabi government officials are Khadem al-Qubaisi and Mohamed Ahmed Badawy Al-Husseiny.

Najib was not named in the lawsuit.

In an immediate response to allegations, the Prime Minister's Office (PMO) said the government would "fully cooperate with any lawful investigation of Malaysian companies or citizens in accordance with international protocol".

According to Najib's press secretary Tengku Sarifuddin Tengku Ahmad, the prime minister has always maintained that the law would be enforced, without exception, if any wrongdoing is proven.

Related reports

It’s official – the 1MDB money was stolen

US$731m siphoned from 1MDB to 'Malaysian Official 1' account, says DOJ

Malaysian gov’t will cooperate with US lawsuits on 1MDB

US delivers a tight slap in the face to M’sian authorities

1MDB says it didn't benefit from items listed in US suit

Red Granite denies 'knowingly used' stolen funds for film

US Justice Dept goes after 1MDB-linked assets; snap polls blizzard in Penang

Minister: Don't rush to judgment on 1MDB crackdown in US

Properties, jet, litany of assets listed in US Justice Dept lawsuits

'M'sians defrauded on enormous scale, 1MDB funds used to pay gambling debts'

Poser over 'Malaysian Official 1' in DOJ's civil lawsuits

‘Surely, Najib won’t accuse golf buddy Obama of conspiracy'

No escape for Najib’s 1MDB troupe

Goldman Sachs under spotlight in Malaysian fund scandal